Standing the Test of Time

Standing the Test of Time

A 147-year-old property/casualty insurer joined the ranks of companies that have maintained a Best’s Financial Strength Rating of A or higher for at least 75 years. Special Section sponsored by LexisNexis.

The Leaders Special Section is sponsored by LexisNexis. Click on the microphone icon to listen to the LexisNexis podcast.

In 1861, the tiny Swiss town of Glarus was hit by a great fire that razed more than 500 homes, rendered 3,000 citizens homeless and signaled what at that time was a lack of adequate insurance coverage in the nation.

In the aftermath of the tragic event, Swiss insurer Helvetia General Insurance Company joined forces with Basler Handelsbank in Basel and the Schweizerische Kreditanstalt bank in Zurich, which is today known as Credit Suisse, to create a company that could provide an effective way of coping with those risks.

After Swiss Reinsurance Company of Zurich opened its doors in 1863 and made its mark in Switzerland and across Europe, company executives set their sights on the American market. In 1873, the company began covering risks for Helvetia in San Francisco.

Swiss Re continued to expand its reach into America, and in 1995 renamed its U.S. operations Swiss Reinsurance America Corp.

In 2019, Swiss Re America became the newest member of property/casualty companies that have stood the test of time by retaining an A or higher Best's Financial Strength Rating for at least 75 years, joining State Farm Mutual Auto, NJ Manufacturers and Amica Mutual, among others.

Coming to America

In 1910, Swiss Re opened its first American branch in New York to write fire business, which was followed a year later with the launch of European Accident, the first U.S. casualty reinsurance company that later became known as European General Reinsurance.

Swiss Re America was incorporated July 26, 1940 under the laws of New York, and operated as a wholly owned subsidiary of European General's U.S. branch until Sept. 30, 1950, according to AM Best. At that time, ownership of stock was transferred to its parent company's home office in London and European General's U.S. branch assets were absorbed while Swiss Re America assumed its liabilities. Stock ownership, AM Best reports, was then transferred to Swiss Re in Zurich, which conveyed the stock to U.S. citizens as trustees.

Swiss Re has over the years earned and validated its place in the U.S. during monumental events such as the 1906 San Francisco earthquake. The company suffered more losses from the event than any other reinsurer, but its rapid payment of claims confirmed Swiss Re's mark and reputation in the American market.

The company was also the reinsurer of the ill-fated Titanic that sank during its maiden voyage to New York in 1912, and in 2001 was the lead insurer of the World Trade Center during the Sept. 11 attacks. That event led Swiss Re into a lengthy and acrimonious court battle with the center's owner, Silverstein Properties. The owner claimed the terrorist attack on the twin towers was a double event, which meant he could potentially collect twice on the policy.

However, in 2006, a New York appeals court ruled in favor of Swiss Re, citing the destruction of the World Trade Center, which was insured for $3.5 billion, was a single event.

Over the past several decades Swiss Re America has grown both organically and through acquisitions such as the purchase of Life Re Corp's life operations in 1998 and its 2006 acquisition of GE Insurance Solutions.

Over the past five years the company's earnings have largely continued on an upward trajectory. In 2019 the company reported $15.8 billion in assets compared to 2015's $12.8 billion. Net income grew in 2019 to $843 million from $389 million in 2015, according to AM Best. Over the past five years net premiums dipped slightly from close to $2 billion in 2015 to 2019's $1.9 billion.

By premium income, the Americas, with $15 billion, is Swiss Re's second-largest market, preceded only by Asia at $16 billion, Swiss Re Ltd. CEO Christian Mumenthaler told investors at the company's investor day conference last November.

Attaining Distinction

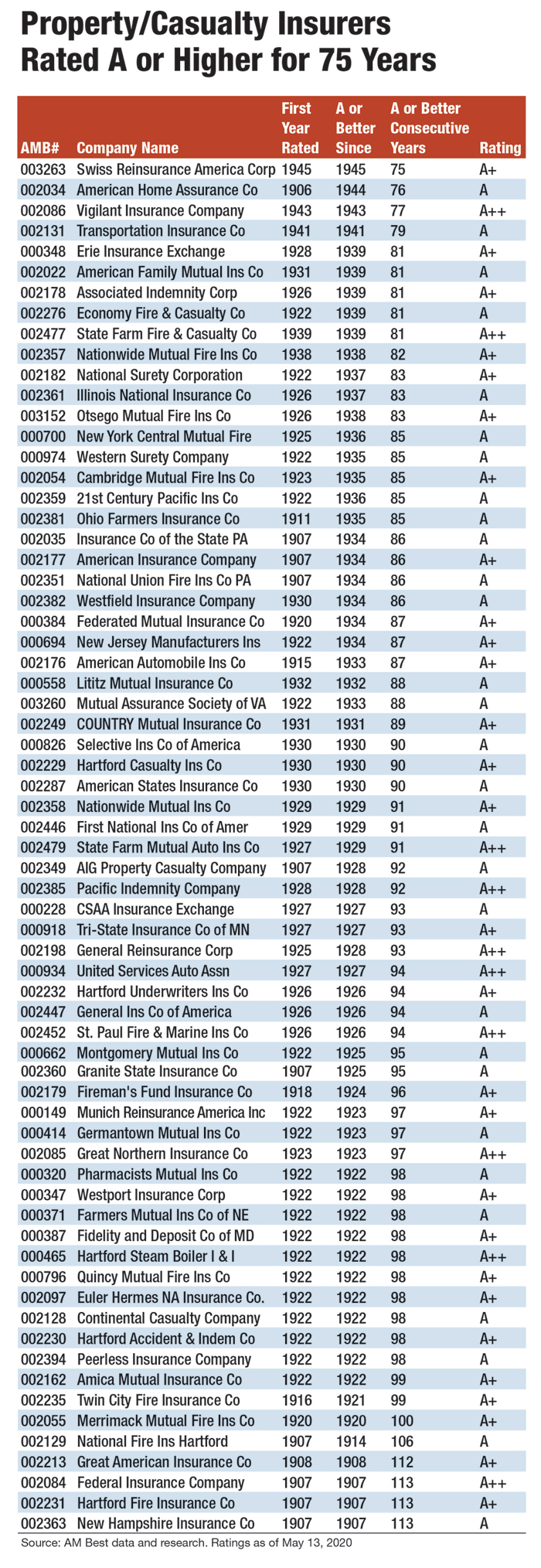

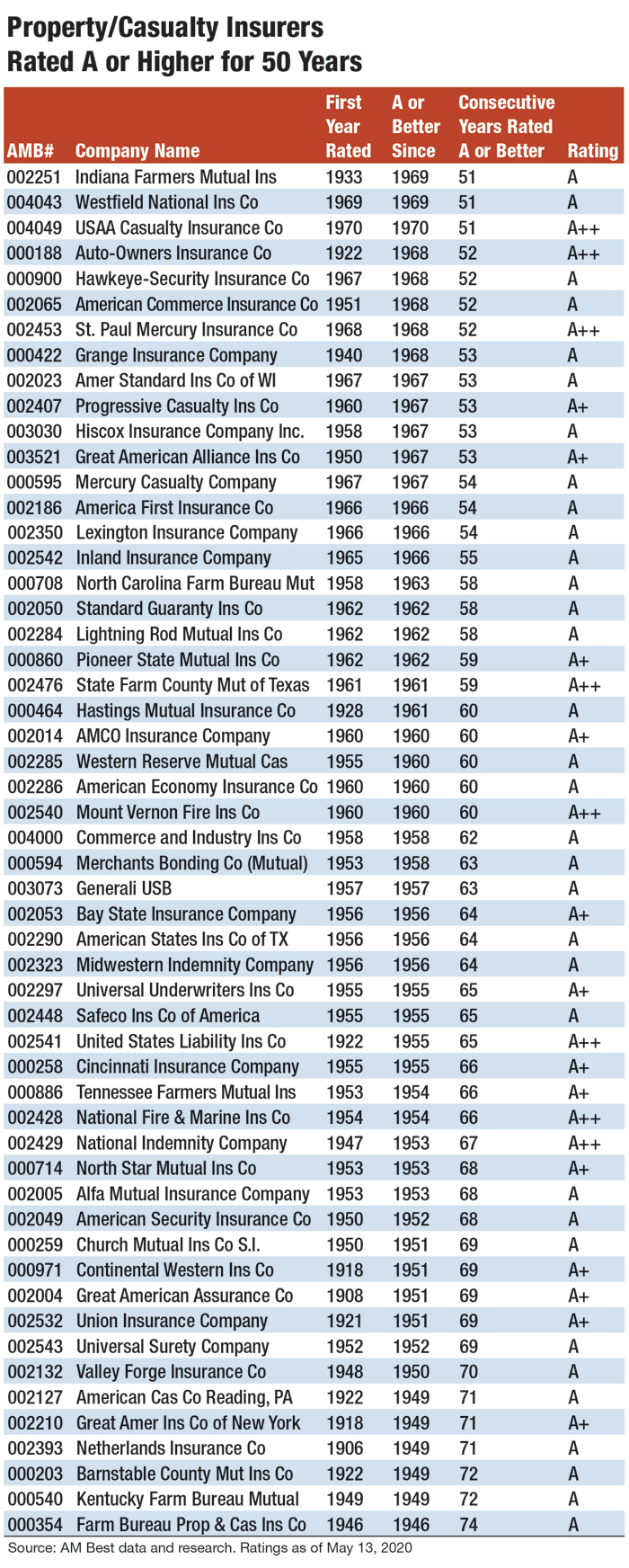

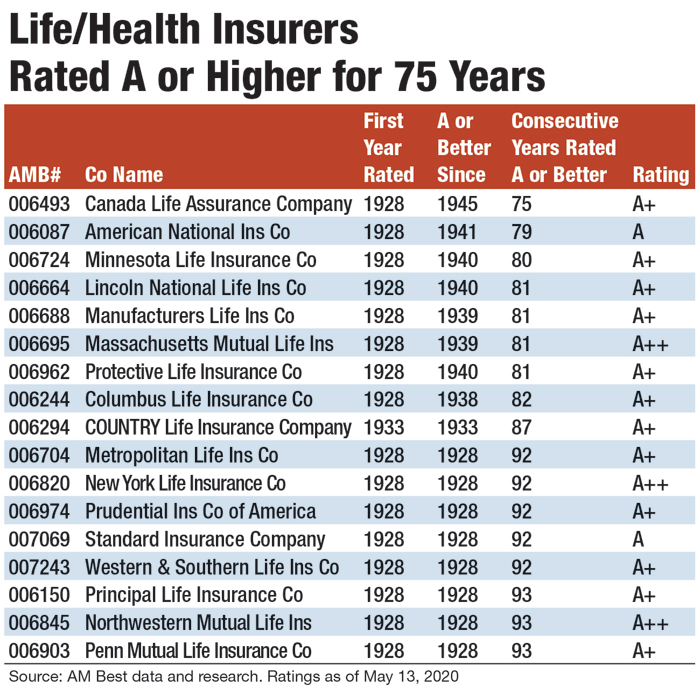

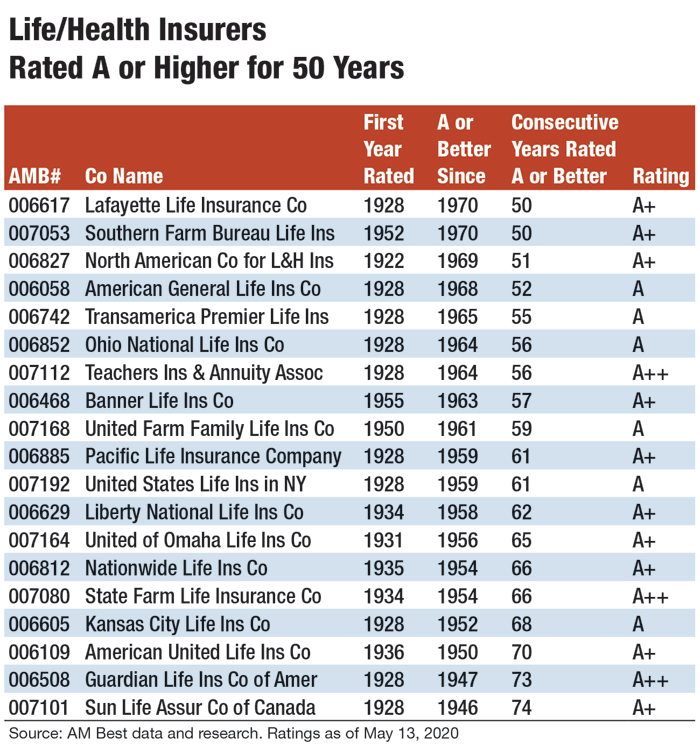

Standing the Test of Time lists all property/casualty and life/health companies that have retained an A or higher Best's Financial Strength rating for 50 years or more and those who held the rating for at least 75 years in 2019.

On the life/health side, 17 companies were part of this group for at least 75 years.

Another 19 life/health companies kept their A or higher rating intact for a 50 years or more.

In the 75 years or more range, 67 property/casualty companies have stood the test of time, and 54 property/casualty companies held that title for 50 years or more in 2019.

Some companies have reached a higher level of distinction in retaining their A or higher rating.

Property/casualty insurers Federal Insurance Co., Hartford Fire Insurance Co. and New Hampshire Insurance Co. have maintained the rating for 113 consecutive years.

On the life/health side, Principal Life Insurance Co., Northwestern Mutual Life Insurance Co. and Penn Mutual Life Insurance Co. maintained their A or higher rating from AM Best for 93 consecutive years.

Life/Health Debuts

Lafayette Life Insurance Co. and Southern Farm Bureau Life Insurance were newcomers to the list of life/health companies with an A or higher rating for at least 50 years.

At the turn of the 20th century, several businessmen dreamed of building a company that could provide the best possible insurance protection at an affordable cost. On Dec. 26, 1905, Lafayette Life was born as a mutual company headquartered in America's heartland in Lafayette, Indiana.

In the following decades companies across all industries were tested by the Great Depression and two world wars. But Lafayette Life stood the test of time and proved its resilience during challenging times. The insurer, although under no obligation, paid the war claims of World War I casualties. It also assisted real estate owners and farmers during the Great Depression by allowing delinquent mortgage holders to deed their farms to Lafayette Life, which then leased the land back to the owners to allow them to keep their insurance, farms and dignity.

In 2000, Lafayette Life, which today offers life and annuity products for individuals and small businesses, reorganized into a mutual insurance holding company structure in order to add structural flexibility, retain its mutual culture, enhance its ability to engage in mergers and acquisitions and access the capital markets to grow and remain competitive with its peers.

Five years later, the company underwent another big change when it aligned with Western &Southern Financial Group, a family of financial services companies whose heritage dates back to 1888.

The impact of that strategic alliance, Lafayette Life said, has provided its company with greater resources and made it stronger and more competitive.

Last year, Lafayette Life's assets climbed to nearly $5.8 billion, compared to $4.5 billion in 2015, according to AM Best. Net earned premiums also increased slightly during that time from $533 million in 2015 to $575 million in 2019. The number of independent producers and marketing organizations offering the company's products has grown to 7,600 from 6,000 in 2015, according to Lafayette Life.

In 1946, the idea for another U.S. life insurance and annuity provider germinated during a candlelight meeting in the Jefferson Davis Hotel in Montgomery, Alabama.

A year later, Southern Farm Bureau Life was born as a capital stock life insurance company. That year, the company issued its first policy and paid its first claim in the amount of $5,000.

Since then, Southern Farm Bureau Life has continued to grow its book of business, including the sale of individual term and whole life products and annuity contracts to more than 2.8 million families in 11 states. In 2018, the company reached a milestone of $150 billion of life insurance in force.

Southern Farm Bureau Life has and continues to be defined by three characteristics: sound, secure and strong. Those key attributes were represented as three branches in the company's first logo, a tree, unveiled in 1947.

While the company continues to operate under that foundation, in 1988, in an attempt to eliminate the sense of fragmented branding that many companies felt at the time, the insurer unified its advertising mark to serve all of its participating companies, augmenting it with the shared brand positioning statement, “Helping You Is What We Do Best.” The logo is still used today and can be seen at events in the many communities the company serves.

In 2019, Southern Farm Bureau Life's assets stood at $14.7 billion, a $1.4 billion rise since 2015, while net premiums topped $891 million, according to AM Best.

Last year, individual annuity sales comprised more than 91% of the company's net premiums.

114-Year Tradition

For 114 years, AM Best has been issuing Financial Strength Ratings or opinions on the ability of individual insurers to pay claims on the coverage they have underwritten.

A select group of carriers has consistently maintained strong Financial Strength Ratings for the past 50 and 75 years.

To identify the companies with the longest record of consistent financial strength, AM Best analysts pored over the rating agency's proprietary data—primarily Best's Key Rating Guides and Best's Insurance Reports—to accumulate and verify ratings and other pertinent data dating back to 1905.

AM Best's Rating Scale has changed over time in an ongoing effort to increasingly distinguish the relative financial strength of insurers and adapt to changes in the insurance industry.

Therefore, in certain circumstances it was necessary to translate or convert various older ratings to conform to the present rating scale. (Note that these translations do not represent any material change or re-evaluation of a company's rating; they are merely a conversion from one scale to another).

The original rating system, implemented in 1906, was devised by the company's founder, Alfred M. Best.

In 1921, a new rating scale, General Policyholder Ratings, replaced the previously used Desirability Ratings, which applied only to property/casualty insurers.

Desirability Ratings consisted of two components: a loss-paying record, ranked on an alpha scale with “A” being the best; and a rating of management quality on a numeric scale with “1” being the best.

An Evolving Process

The rating scale adopted in 1932 had two components: the New Resource Rating, the forerunner of today's Financial Size Category; and the General Policyholders Rating, which evolved into today's Financial Strength Ratings.

From 1935 to 1975, AM Best did not assign letter ratings to life/health companies. Instead they had “comments.”

In order to complete this rating history project, a translation was devised to convert these “comments” to equivalent letter ratings. For example, from 1935 to 1952, “More than Ample” was found to be equivalent to today's “A” rating.

Best's Ratings

The Rating History Project is based on Best's Financial Strength Ratings. A Best's Financial Strength Rating is an independent opinion of an insurer's financial strength and ability to meet its ongoing insurance policy and contract of obligations. The rating is based on a comprehensive quantitative and qualitative evaluation of a company's balance sheet strength, operating performance and business profile.

AM Best was founded in 1899 with the purpose of performing a constructive and objective role in the insurance industry toward the prevention and detection of insurer insolvency. This mission led to the development of Best's Ratings, which are now recognized worldwide as the benchmark of assessing insurers' financial strength. Best's Ratings' opinions reflect an in-depth understanding of business fundamentals garnered for more than 100 years of focusing solely on the insurance industry. This is one reason why insurance industry professionals have consistently ranked Best's Ratings No. 1 in confidence, usefulness and understanding.

A Best's Rating is an independent third-party evaluation that subjects all insurers to the same rigorous criteria, providing a valuable benchmark for comparing insurers, regardless of their country of domicile. Such a benchmark is increasingly important to an international market that looks for a strong indication of stability in the face of widespread deregulation, mergers, acquisitions and other dynamic factors.

Anniversary BestMark

AM Best has a program to recognize insurance companies that have maintained a Financial Strength Rating of A or higher for at least 25 years.

The Anniversary BestMark program consists of a special icon—distinct from the standard BestMark—that incorporates the company's name and acknowledges the year a company first achieved the Financial Strength Rating of A or higher.

Print and internet-compatible versions of the icon will be supplied.

Eligible companies can use this icon in a manner similar to the current BestMark—for example, on their websites, in print and online advertising, and on the cover of Best's Rating Report reprints.

Eligible companies may request an Anniversary BestMark via email to bestmarkinsurers@ambest.com.

YOUR COMPANY NAME HERE

See also:

Remote Access

Top Global Insurance Brokers

Top 200 U.S. Property/Casualty Writers

Top 200 U.S. Life/Health Insurers

Top 75 North American Public Insurers Ranked by 2019 Assets

Top 75 North American Public Insurers Ranked by 2019 Revenue

Top U.S. Holding Companies

World's Largest Insurance Companies