Experts: Slow increase in interest rates likely to help captives’ portfolios.

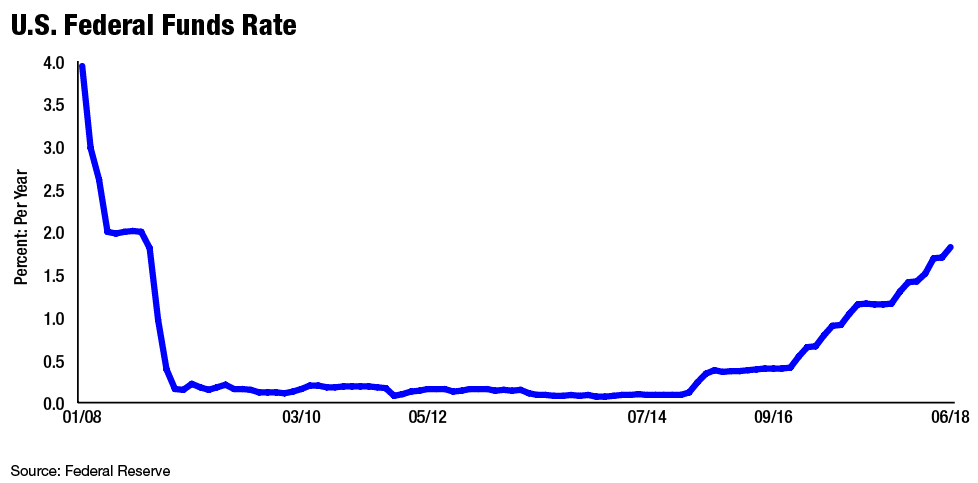

After a decade of low interest rates, the Federal Reserve raised rates twice in the first six months of 2018 and indicated two more hikes could come by year-end.

In March, it raised rates 25 basis points to a range of 1.5% to 1.75%. A June increase—the seventh since the end of the Great Recession—lifted the benchmark range for federal funds another 25 basis points to between 1.75% and 2%, the highest it's been since the summer of 2008.

The timing of the Fed's second hike made interest rates a hot topic at the Bermuda Captive Conference in June. A.M.Best TV asked investment managers and captive experts how rising rates are affecting captives and how insurers should deal with the economic shift.

Weighing in were Bob Gagliardi, head of captive management and U.S. fronting for AIG; Mark Jennings, senior vice president at Wilmington Capital Securities LLC; Jack Meskunas, senior director at Oppenheimer & Co.; Jonathan Reiss, chief financial officer of Hamilton Insurance Group; Scott Reynolds, CEO of Member Insurance; and Carl Terzer, principal at CapVisor Associates.

What are the pros and, if any, cons of rising interest rates?

Reynolds: Rising interest rates can create an opportunity for increased investment income, so from a captive perspective, the rising interest rates aren't necessarily a bad thing.

If they go up too fast and it drives bond yields down, or bond rates down, collateral requirements could go up quickly. You have to be careful that the rates don't go up too fast. Rising rates are good, but rising rates all of a sudden are not good.

Reiss: Companies that have large fixed-income portfolios may see a book value hit to their portfolios when interest rates rise. In the longer term, or the medium to long term, they're better off. Rising interest rates means better, higher yields. I think it's a net positive.

However, the caution is: How does the rising interest rate environment manifest itself in claims inflation? That's an area, depending on the lines of business you write, you have to be very careful about.

I would also just like to mention that it seems that our industry has had excess capital allocated to it, in part because of the depressed interest rate environment and investors looking for more yield in our industry. I generally think the rising interest rate environment will help alleviate that challenge as there are better yield opportunities elsewhere.

Has this already affected investments?

Gagliardi: For some captives that have a fair amount of assets, maybe collateral trust account, they see the rising interest rates driving the value of their investments down a bit. That's probably been a little bit of a negative for them. But for clients that have been in cash, or primarily in cash, now they see some return on that cash that they weren't seeing before.

I think on the whole, long term [the rate increase] is probably good for us. But in the short run, it has hurt the value of some clients' investments.

Meskunas: What this has done is impact the valuation of fixed-income portfolios. You can see it all across the spectrum, both on the short end, the intermediate end where the 10-year topped 3% recently, and to the long end as well. So this has caused a lot of captive owners to see declines in value of the portfolio.

How should the captive industry be responding?

Meskunas: You need to be nimble and you need to have specific bond portfolios as separately managed accounts, as opposed to bond funds. Bond funds fare more poorly in a rising interest rate environment typically than individual bond portfolios because the asset manager always has the opportunity to just hold on to the bonds and let them mature. Therefore you won't suffer the type of losses that you get in a fund.

Terzer: Bond portfolios don't do well in a rising interest rate environment. As interest rates rise, the market value of the bond portfolios will decrease. You hopefully look to have your manager position the portfolio with a duration short of the benchmark, which will protect it at least vis-à-vis the benchmark, from a large market value hit to the portfolio.

What does this mean for the captive asset management space?

Terzer: With interest rates rising and that being the overall mindset of the Fed, captives are a little more in tune to what their bond managers are doing and they're a little more demanding of performance and overseeing performance more closely. Of course, we had so many years with very low returns, the dispersion in manager returns was very, very low. They're becoming more in tune now with finding managers who can outperform.

Jennings: I think insurance companies are responding by investing in floating rate securities, investing in preferred securities, or different asset classes that are diversifying their portfolio. They're not tied to fixed-rate securities while there's a rising interest rate market.

Meg Green is a senior associate editor, A.M.BestTV. She can be reached at meg.green@ambest.com.