Insurtech: MassMutual Ventures

Covering All the Bases

MassMutual Ventures’ managing director Doug Russell talks to AMBestTV about the wide-ranging strategy the company is taking regarding investments, partnering and expanding abroad.

Photo Credit: Kim Bjorheim

Though traditional venture capitalists and private equity once were the primary investors in insurtech startups, funding increasingly has come from insurers and reinsurers. According to some estimates, industry players, either through direct investments or corporate venture capital arms, have been involved in 75% of funding deals in the past few years.

Doug Russell, managing director and head of MassMutual Ventures, spoke with AMBestTV about insurtech trends, MMV's approach to investing and his team's overseas expansion plans.

Following is an edited version of the interview.

Insurers have taken several approaches to insurtech. Some are building it from within, some are partnering, some are funding it externally. What's MassMutual's approach?

Our approach is really across the board. As you mentioned, I'm responsible for our venture team investing. We stood MassMutual Ventures up in 2014 for the sole purpose of looking to find great insurance technology, financial technology companies to back, entrepreneurs to back.

Also, if you look more broadly at MassMutual, we've got a number of innovation efforts underway in the operating businesses, including starting a company called Haven Life.

We're increasingly partnering with outside vendors, so our operating model has evolved similarly to what you described. Our approach is really to cover the bases across partnering, innovating internally, and then building the venture team as well to focus on investing and new startup companies.

Speaking of building the venture team, you recently made a large commitment to Southeast Asia. Can you tell me a bit about that?

We started MMV in 2014. Late last year, we started talking about: How do we want to build our business over the course of the next four or five years? To think out to 2025, 2030, what would MassMutual Ventures look like?

We made the decision that we really want to build a global platform so that we have direct investing teams in different markets.

It's really to take advantage of the trends that we're seeing with regard to the increasing demand for insurance, individuals moving into middle classes in developing markets, what's happening on a technology front. A lot of these trends we're seeing in other parts of the globe.

In addition to having [our] first $100 million U.S. fund, we secured approval for our second fund for the U.S. But then earlier [in 2018], we did make the commitment and got the approval to start MassMutual Ventures Southeast Asia, which is a dedicated US$50 million fund, based in Singapore but focused on Southeast Asia investing. Two individuals have joined us as partners out in that market.

What do you seeing coming out of Southeast Asia?

Very early days. We just formally announced a couple of weeks ago, but you actually see a number of interesting businesses emerging on the enterprise software side, on the digital distribution side.

The health tech side is very interesting in terms of some of the products that are being manufactured, the distribution models in those businesses, particularly taking advantage of the mobile phone.

You've got a lot of mobile engagement happening across Southeast Asia. You've got the existing incumbents out there that are looking to partner with the startups as well, to help their businesses grow. That would be on the data side and on the security side.

Is it important to you to invest in companies that MassMutual can partner with, or is it more just about the financial return?

It's not just about the financial returns, but our foremost focus is on generating returns for our policyowners ultimately. So we are a return-oriented fund, first and foremost. We have a strategic mandate that relates broadly to the businesses that we're in, but we're not making investments with a condition that we establish a business relationship.

If it makes sense, we look to broker that relationship, but we're a third party that is hands off, and we really let it happen on an arm's-length basis. We're also looking to help our entrepreneurs and the businesses we back by introducing them into the network that we've got more broadly, not just the MassMutual network.

We're really looking to back businesses. If we can establish a relationship with MassMutual, that's great, but we're looking also to help them even more broadly than with MassMutual.

What is your criteria for investing?

The criteria, first and foremost, is looking at the markets or the sectors that we're interested in, that we think we have some capability or knowledge to understand, and then finding the entrepreneurs that are building businesses in those sectors that we think are backable. Do we believe that they understand the market, that they have the ability to execute in that market?

It's really about, in the early stage businesses, the management teams. Do we think that they can execute the plans that they've laid out? That's first and foremost, then the criteria gets into the financials, and the growth and the exit at some point in time.

At the end of the day, it really does come down to the team that's being built and their ability to execute. That's the primary, most important criteria for us.

Do you have a preference for any particular stage of investing?

Preference is A. We'll do seed stage investments on a rare occasion if we have real conviction about the sector, and real conviction about the management team. We're not doing enough seed stage investing to really know whether we're backing the right company. The risk of loss, the probability of loss, at the seed stage is very high.

If you look at some of the statistics, [most seed stage companies] don't make it through to a C round, for example. So our job is really to find those early stage companies that have been backed by seed investors. We work with those companies until they're positioned to do the A, and then we come in at the A. That's our objective.

Have you had any investments that you would identify as winners or any big disappointments?

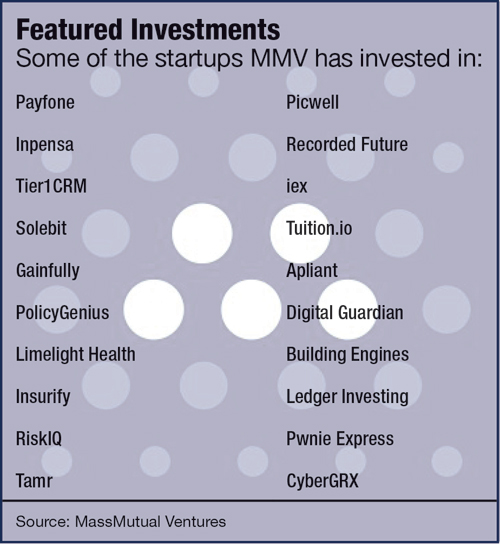

Yes. As you would imagine, we have 20 companies in our first portfolio, so we're fully invested the first $100 million. We've got reserves for following investments, still allocated to some of those companies. With any portfolio of venture-backed companies, we've got some that have well exceeded our original expectations.

We've had one exit. We had one company that we invested in that was sold [in 2018] at a very, very attractive return, well above our expectations. So we're pleased with that.

We have several companies in the portfolio that are performing poorly, but that's not unexpected. While that's a disappointment, it's a natural course of doing the kind of investing we do. I would say on balance, we're pretty pleased with where we stand right now, four years in with that first fund. But again, time will tell.

You mentioned an exit. Do you have a certain time frame in mind for the length of your investments?

The idea is that we're investing over three (plus or minus) years, and that we're likely holding those investments for seven to 10 years. Again, four years in, we've had one exit, and so we think over the next couple of years, we'll start to see more exits, which is what we assume.

We model, and plan, and think about exits in that seven- to 10-year time frame, and we work very closely with the management teams to understand what their objectives are for ultimate exit as well.

The insurtech space has slowed down a bit in the last year. In the first half of 2018, there were only four new insurtech startups launched, according to Venture Scanner. In 2017, the number was 88, which was a 50% reduction from 2016. Is the market saturated? Have we hit an inflection point?

It's a good question. I'm not sure it's a saturation, as much as just a recognition that building a brand new insurance technology business is difficult. It requires significant capital, significant staying power.

I think what you're finding now is that many of those [startups] are what we're calling the digital distribution, the front end. They're building really great models for acquiring and retaining customers, but then they're recognizing the legacy businesses that they need to plug into, if you will.

They're still struggling with the traditional carriers that they need to connect to. So maybe the experience isn't quite what they thought it was going to be. I think we're also seeing, with some of those companies, that the actual premium equivalent, or the revenues associated with the business that they're attracting, is smaller because typically it's an online or direct business model that's been built. So the revenues are small relative to the cost.

Broadly speaking, I think it's a pause. ...I think the other consideration here is the capital. It's institutional capital, including ours. Evaluations are important to us as well, so I think at times, there's a mismatch in terms of the expectation of the value from an entrepreneur with what we as an investor are willing to pay. I think that might be causing some of the slowdown as well.