Data: Emerging Technologies

Technology and Transformation

Insurance panel: Genomics, blockchain are likely to be “big transformable technology” for the insurance industry.

EMERGING TECH: Tom Van den Brulle of Munich Re (left), Koichi Narasaki of Sompo Holdings and Edin Imsirovic from AM Best discuss innovation in the insurance industry.

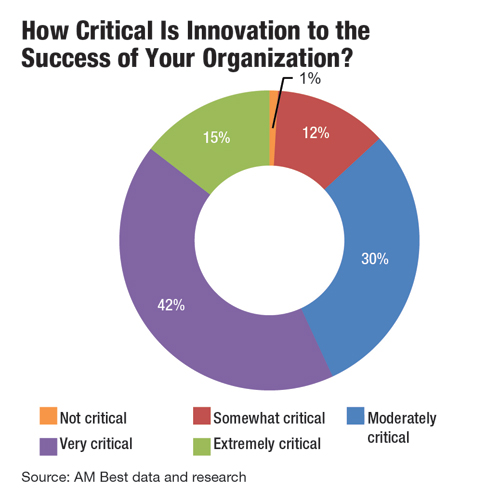

More than 80% of insurers say innovation is moderately critical to extremely critical to their organizations, according to an AM Best survey. But while innovation may be the buzzword du jour, defining its meaning is not necessarily a top priority for executives in charge of it.

“We don't really define it,” Tom Van den Brulle, global head of innovation for Munich Re, said. “We're not interested that much in the definition of innovation, because it takes your time and focus. What we're interested in is finding new business models. That is the focus of what we're doing.

“We're trying to understand what are going to be the business models that are going to make a difference in the future. That is probably, at the end of the day, our definition of innovation.”

Koichi Narasaki, group chief digital officer for Sompo Holdings, said innovation is about self-transformation.

“Your definition of innovation itself doesn't really say anything,” Narasaki said. “What we're trying to do is more leaning toward a disruptive innovation, which means a redefinition of ourselves, our business, our processes, our customer experiences.”

AMBestTV sat down with Van den Brulle, Narasaki and AM Best Senior Analyst Edin Imsirovic to discuss which emerging technologies could transform the industry. Below is an edited transcript of the conversation.

What are some of the technologies that could shape the future of insurance?

Imsirovic: To me, it's not about specific technology. It's about a whole host of different technologies coming together and creating value within a value chain or transforming the value chain. It's not necessarily about the disruption. It's about the transformation of the insurance industry.

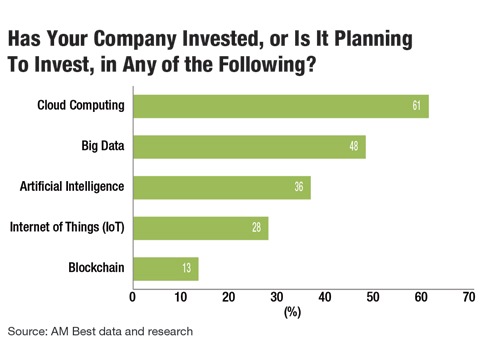

We're increasingly seeing digitalization of the physical world driven by the explosion of data, explosion of IoT devices, and AI analytics. That's really allowing us to analyze and automate the world at an unprecedented level of detail.

The implications of this for the insurance industry are really interesting.

Van den Brulle: I do agree. At the same time, there are a couple of technologies out there that might be interesting as technologies to the insurance industry.

When you're looking at genomics, for example, what it can do to life insurance and personal insurance, and how you can evaluate risk only through analyzing their genetic information. That has a huge impact on how life insurance, probably also health insurance, is going to be assessed and sold in the future. That is a clear technology issue.

In terms of changing the way insurance works, which technologies have the most promise?

Van den Brulle: Blockchain technology has a very clear implication on the business model and how insurance, as a business model, is going to be put together.

I'm not saying they're going to be necessarily successful. What RiskBlock is doing, what B3i is doing, what different initiatives are doing in terms of putting together a digital marketplace on the blockchain technology—that has a big implication technology- wise only.

For AI and machine learning, I'm completely with you. That it's more about, OK, how do you use it? How do you implement it into the, let's say, classic value chain if you like? For genomics and blockchain, for example, it can be different.

Narasaki: I could not agree more. If I am to pick out the big transformable technology or technology as a catalyst for our industry, blockchain and genomics. By the way, we're digging into both of them very seriously because we are probably betting our firms on these two things to completely transform or better our industry.

The blockchain is not just simply a distributed ledger; it is a marketplace. Also, it's a network of trust. You can't cheat somebody. You can't con somebody. It's completely democratic and distributed. In that way, nobody can mess with this.

Imsirovic: I absolutely agree on the blockchain. The exciting part about blockchain, to me, it removes friction from the economy. It removes the centralized trust managers or third parties from the equation and emulates them through algorithms and cryptography.

Three years ago, I felt like everybody was talking about blockchain. Why isn't it widely used yet?

Van den Brulle: The insurance industry has not yet thought through the opportunities of blockchain because we were so obsessed with cryptocurrencies in the first place. Cryptocurrencies are just one application of blockchain. There can be many more.

The second thing is that the human brain has difficulties to understand and to project this distributive way of sharing information or sharing information and processes. It's much easier to project it in a central manner.

The third thing is that the first-use cases are just out there. Give it some time to really understand what they can come up with. The first products on flight delay and weather-related insurance products have been tried out. A lot of learnings have been gathered, but I'm sure there's more disruptive stuff to come.

What are some of the emerging technologies that you find personally really exciting?

Imsirovic: Quantum computing. I just find it exciting. We're reaching the limits of Moore's law, at the moment. We're at the 10 Nanometer process. We are getting subatomic interference in the processes and so it's a whole new paradigm of computing.

I feel it's a type of technology that can advance AI. AI in current uses is very narrow and we need to expand it. I think quantum computing may allow us to do so.

Narasaki: Yes, quantum computing. Currently, Moore's law is in a way hitting the wall. From this point on, to overcome let's say the wall, firewall, or Chinese wall, we have to have something disruptive.

Van den Brulle: I'm more of a simple guy, but I am already very excited by the application of AI technologies and machine learning to what we're doing today. I find that breathtaking, honestly. I couldn't have imagined it two years ago.

We’ve learned that hierarchies don’t make that difference. We have to listen to people who know, rather than to people who have a certain role and a certain responsibility in the company.

Tom Van den Brulle

Munich Re

Technology is one aspect of innovation. What are some of the other big pieces of it? Talent?

Van den Brulle: I'm glad you say that. I'd been saying this just the other day in a meeting: It's about mindset and people. How creative they are. How they blow you away with new ideas and with sheer energy and willingness to understand things and to develop things. That's much more powerful than every technology that I have seen so far.

Has your view of the role of technology in innovation changed? Did it used to be about the technologies, and now you've broadened the view and say it's at least as much about the people?

Van den Brulle: That's a good question. The only thing I have learned is that we don't know enough, so we're constantly learning. It's not only in terms of how to manage things but also technology-wise. You need to constantly learn and understand how things work in order to put them together to the benefit of our clients and our investors. What can be new in business models, products, services? How can you use this?

The second thing is, we've learned that hierarchies don't make that difference. We have to listen to people who know, rather than to people who have a certain role and a certain responsibility in the company. That gives a different flavor to how you're doing things and how you're working together.

Narasaki: The same thing is applicable to us in that, in the current state of industry, the best management is agile management and listens to the knowledge and the insight of others. Otherwise, if you stick to your own legacy kingdom, you'll be doomed.

If we are sitting here five years from now talking about innovation or technology, what do you think the content of the conversation would be?

Van den Brulle: I think there's going to be a question, in five years, around one of the big noninsurance companies having entered the insurance space and what role they'll play. The Amazons, the Facebooks, the Alibabas, Baidu, or whoever you want to choose. What their role will be and how they have entered that space.

Do you see that as inevitable, those big technology companies moving in?

Van den Brulle: I see it as a threat, as they have a lot of access to clients, they have a lot of relevant data, they have capital, and they have the intellectual ability to take things further.

We thought a couple of years ago that insurtechs were going to disrupt the industry. We probably slightly nuanced our opinion now versus those companies who really have superior data access.

Do you combat that threat?

Van den Brulle: We're trying to be creative and ambitious, as well. ...We want to go more into the preventive space, using that data and knowing when we have to do something in order to avoid business interruption. That is a completely different business model. That is not insurance. That is not a financial product anymore. That is a Software as a Service model with a prevention model. I think we as insurers should sometimes be a little more ambitious in where we can manage risks and where we can offer protection to the economy.