CEO Interview

The Next Chapter

Thomas Buberl has reinvented Axa, as well as himself.

Photo courtesy of Axa.

In order to be successful, you need to reinvent yourself constantly. This capacity to reinvent, to question, to constantly learn, is the most important thing.

Thomas Buberl

Axa

Thomas Buberl was given an assignment by the board of Axa: Write a book about yourself.

The French insurance company was searching for a new CEO. But before it took a chance on the young candidate, the board wanted to make sure he had the vision and wherewithal to handle what it was about to task him with.

Axa, the world's second-largest insurance company, was looking to make a momentous shift. It needed a leader who could execute on that.

As part of the vetting process, the board asked Buberl, then 42, to write three chapters answering these fundamental questions: Who are you? What's your vision for Axa? How would you implement that vision?

Buberl was slightly annoyed.

“At the time, it was very challenging to spend all this time on this document while continuing my day-to-day responsibilities,” he said. “But I must say, in hindsight, it was probably the greatest preparation for me.”

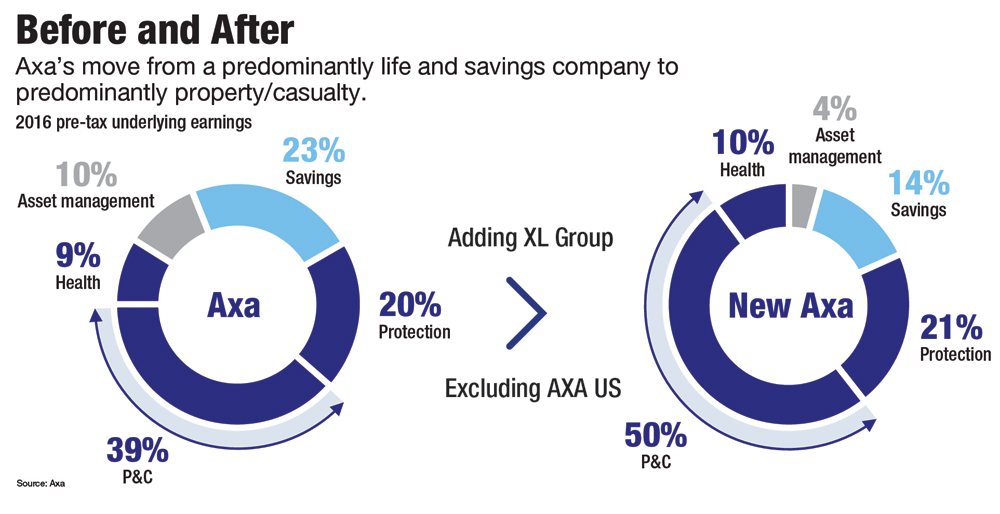

Since being appointed CEO in late 2016, Buberl has led Axa through one of the most radical transformations the insurance industry has seen. By selling most of its stake in Axa Equitable and acquiring XL Group, Buberl effectively reshaped Axa from a life and savings company into a property/casualty insurer.

It was a bold move. And it was met with criticism and skepticism.

Investors didn't understand the vision. Analysts called the logic of the transactions “less than compelling.” The company's stock dropped nearly 10% in one day.

“I won't even attempt to lie. Yes, I was worried,” Buberl, 46, said. “When you have a strategic view and the market gives you a reaction that is completely the opposite, you start doubting.”

That's where the book came in.

In the midst of the turmoil and throughout Axa's transformation, those chapters have served as both Buberl's bedrock and his road map. They have reminded him of the values he holds, the goals he set for the company, and the two failed careers that left him perfectly prepared for a moment such as this.

The writing assignment forced the Germany native to reflect on the events, both good and bad, that have shaped him. He thought of his successes, which were driven by a willingness to do jobs no one else wanted. And he was reminded of his setbacks—a failed attempt at becoming a professional musician and a failed business as an arborist.

More so, he was reminded of his response to those failures. Each time, he reinvented himself.

Now he is helping Axa do the same.

The Mandate

Buberl was given a directive by the board of Axa: Weatherproof the company.

“The board decided to jump a generation,” he said. “They didn't take someone who was 50 or 55. They took somebody who at the time was 42 and who wasn't French, which was quite a rare move. But there was a very clear aim. They said, 'Our mandate to you is that you need to transform this company. You need to make it weatherproof for this next digital phase.'”

That meant shifting Axa's business mix. With life insurance regulation increasing, growth slowing and globalization causing capital markets to become increasingly interlinked, Axa determined it needed to desensitize itself to volatile financial risks and focus on lines of business that are close to the customer.

It wanted to move from a being payer of bills to a partner of the customer.

“Our strategic question is and was: Are we becoming a balance sheet provider, issuing products and letting others distribute them without having any end customer contact?” said Buberl, who holds an MBA from Lancaster University in England and a PhD in economics from the University of St. Gallen in Switzerland. “Or should we become an orchestrator of a community of insured people who we can help live a better life?

“We have opted for the second one.”

Buberl laid out a strategy to move away from businesses where returns were linked to financial markets. Part of that strategy included divesting from Axa's U.S. life insurance business, Equitable. Following a May 2018 IPO and an April 2019 secondary offering, Axa has reduced its stake in Equitable below 50%.

Axa also restructured its Swiss life unit and sold both its variable annuities business in Europe and Axa Life in Ireland.

The moves weren't solely to avoid volatile markets. Regulation of those businesses also was increasing, particularly in Europe, Buberl said. And growth was limited.

“People are more concerned by risks that are emerging, so take climate, take cyber, take health,” said Buberl. “Those challenges create a different and more overwhelming anxiety about future events than death and disability, which are risks we've always known. The needs are more important and therefore they represent an important growth prospect for us.”

If the life business was to shrink, though, other areas would have to grow.

Axa targeted three segments for growth—Health, Protection and Commercial P&C insurance.

To Buberl, the three segments are quite similar.

“We want to focus our activities on businesses that are, by definition, close to the customer, where there is a high frequency of interaction and a high need of expertise, where people want to talk about their risk because they want to reduce it,” he said. “This is the case in health and protection, and this is the case in commercial insurance.

“On the health side, you are concerned every day with what you drink, what you eat, how long you should sleep, which doctors you should go to. The same is true on the commercial side. Health, for companies, is about: What are the risks of the company? How can you reduce the risks?”

The XL Acquisition

There was one catch, though. Axa was never known for commercial lines.

That changed with the $15.3 billion acquisition of XL Group.

“XL makes us immediately the No. 1 largest commercial insurer globally,” Buberl said.

Not only would XL give Axa scale, but commercial relationships would open doors for the health and protection sides of the business.

“When you think about commercial companies, you have both topics addressed,” Buberl said. “You have the commercial risk, but you also have the risks of their employees, the health and protection of their people. In one customer, you've got all of the elements that we want to be strong in, that we are strong in.”

Buberl may have been confident in that vision, but the market certainly wasn't. Investors questioned both the logic and the large price tag of the acquisition. On March 5, 2018, the day the deal was announced, Axa's stock dropped nearly 10%.

“Axa's sharp fall ... suggests high level investor angst at the unexpected acceleration in corporate and strategic actions to reposition the group towards more underwriting risk,” investment bank Jefferies International wrote in a research note.

Macquarie Capital said the logic for the transaction “seems less than compelling in our view and we expect the core business growth is weaker than many believe.”

UBS called the acquisition “a departure” and “not an obvious fit” for Axa, which historically has grown via bolt-on acquisitions rather than large-scale M&A.

For Buberl, the negative reactions hit hard.

“It was not a pleasant moment,” he said. “Standing there wanting to explain to the market an acquisition that I was very proud of, and getting a reaction of minus-10 percent of the share price. That doesn't really make you feel great, even if we were prepared to that reaction. (We had the same when we bought Winterthur in 2006.)”

In the midst of the disappointment, Buberl thought about the first chapter he wrote for Axa: Who are you?

“You don't ask yourself that question very often,” Buberl said. “Who you are is very much driven by your past and what shaped you in your past. What are the elements of success, and also what are the elements of failure and of big disappointments, that have shaped you?”

The Failures

Buberl's successes have come from following one guiding principle: Take the tasks and the challenges no one else wants.

He landed in insurance by doing just that. After earning his MBA, Buberl joined the Boston Consulting Group as a 26-year-old. Six years later, Winterthur Group in Switzerland offered him a job as chief operating officer and, later, chief marketing and distribution officer.

“I was 32 years old and had no idea about distribution,” Buberl said. “The whole distribution area needed to be rebuilt. Nobody wanted the job. So I thought, 'OK, I can lose nothing. I can only gain. It's at the bottom. I'm young. I have got no risk. Let's give it a try.'

“I tried it and it was a great success.”

After excelling at Winterthur, Buberl was nominated in 2008 as a Young Global Leader by the World Economic Forum. That same year, he also was named CEO of Switzerland for Zurich.

But for Buberl, who joined Axa in 2012, his failures are far more interesting than his successes.

Growing up, he was an aspiring musician. He played the organ, but he couldn't sing well. Nor did he spend much time practicing his singing.

“I went very far down the road of becoming a professional organist,” Buberl said. “But I was always procrastinating with the singing. I knew in my last exam that I would have to sing.

“So obviously I failed the last exam, which stopped completely my career in music. For 10 years afterwards, I never touched an organ again.”

With that chapter closed, Buberl reinvented himself. He followed his next passion, forestry. He started a company that cut down trees in difficult settings—between buildings, close to motorways, etc. A workplace accident caused him to close the business and return to business school.

“Luckily I came out well,” Buberl said of the accident. “But I said, this is not for me. I need to stop here.”

Two failed careers taught Buberl a lesson.

“In order to be successful, you need to reinvent yourself constantly,” he said. “This capacity to reinvent, to question, to constantly learn, is the most important thing.”

He drew on that philosophy when Axa's stock tanked.

“It's the capacity to reinvent yourself and say, 'Minus 10%? It is what it is,'” he said. “That doesn't mean I'm going to resign tomorrow. It gives me personal motivation. It tells me, 'You haven't explained this well enough and you now have to convince those investors. Now go and try harder.'”

Buberl was advised to let investors cool down. Instead, he doubled down.

“I was convinced, our teams were convinced. I was dedicated to fight for that vision,” he said. “Many people told me to withdraw from the market. They said, 'Give time to the investors to digest this news, and in half a year, you try again.' I said, “No, I need to do exactly the opposite. I need to engage more. I need to understand more. I need to fight for our strategic vision.'”

Buberl and his team made a concerted effort to explain the rationale and benefits of the acquisition. They also addressed concerns around the execution risks. Not only was the XL acquisition complex, involving 60 countries, but it was also being funded in part by capital raised from the Equitable IPO.

He understood why that would make people nervous. But he was confident that investors and analysts would get on board, if only they understood the vision.

“When we sat down and explained it, all of a sudden people saw it,” Buberl said. “Yes, it's a bold move. Thanks to this acquisition, we have leapfrogged probably many years of organizational organic development. Yes, we also were lucky, because to dispose of something [Axa Equitable] and to find something else [XL Group] at the same time, this is very rare. Stars need to be aligned.”

The Integration

Nearly a year after the September 2018 closing of the deal, Axa's stock is trading around the same level as it was when the acquisition was announced. Now Axa is working its way through the integration process. It hasn't been hard, Buberl said, but it also hasn't been easy.

The companies are quite different.

“Serving large customers versus serving retail customers in travel insurance is a little bit, I would say, like investment banking versus retail banking,” Buberl said. “You have different cultures. That probably has been for us the most important.”

Buberl said he is hoping to preserve XL's best qualities and infuse them into Axa.

“XL is very entrepreneurial, very solution-driven, and very customer-oriented,” he said. “When you talk to the XL people about a new challenge, a new issue that has come up, you always find they have an extreme desire to find a solution, to act in the customer's interest, and to be pragmatic.”

To retain the best of both companies, Buberl and his team defined four values for Axa—courage, customer first, One Axa, and integrity.

“Integrity has been a very strong value of Axa from the very beginning,” Buberl said. “Customer first is a very strong value of XL in particular. Courage is a value that we both have. One Axa is essentially: How do we bring Axa and XL together to make it a combination that is more than just the individual pieces alone?”

Buberl doesn't have the answer to that question. Nor does he feel the need to.

“My task is not to command and control the execution of the integration,” he said. “My task is to create an environment, to create an inspiration, and to create the interest for these people to see that there is a new opportunity that hasn't existed beforehand.”

The Next Chapter

Buberl decided recently to revisit his book. He wanted to see how closely aligned he is to what he wrote three years ago. Those chapters are a benchmark.

“I'm still about 90 percent aligned,” he said.

As he read the book and thought about Axa's transformation, Buberl said he connected the dots. Integrity. Courage. Customer first. Teamwork. Those weren't just Axa's values. They were his.

“Integrity is very important to me,” he said. “Being truthful to yourself, listening to feedback, being able to be confronted with things you should change. Courage is certainly a great value, and I think you've seen proof of that in the transformation of Axa. But courage also, in a way that if there are setbacks, you don't withdraw and say, 'I'm not doing this anymore,'”

One Axa, for Buberl, is about being a team player.

“I do believe that, yes, I am important in the game,” he said. “But I'm not the most important. I'm just one piece in the puzzle. My task is not to bring all the answers. My task is to bring together, enable and facilitate.”

Putting customers first was a value Buberl learned at the Boston Consulting Group. After his tree-cutting business failed, Buberl became a consultant, in hopes of finding an industry he could envision himself in. That led him to insurance. It also gave him a strong foundation of customer centricity.

“One interesting skill consultants have is they don't reinvent the world; they find a solution within the company,” Buberl said. “So my strong belief and value is: The answer is always in yourself and the answer is always in the company. You need to go and search for it.”

In today's Axa, Buberl doesn't need to search far for answers and ideas. Looking across the new company—whose operations are now 80% technical risks—he sees no shortage of resources. The next challenge will be to leverage that know-how, maximize the company's market leader positions, and deepen customer relationships. Buberl also wants to bring a peer-to-peer element into the business.

“The model that we envision, let's say in 10 years,” Buberl said, “is to be an orchestrator of a community of insureds who have the same interests.”

That, however, is for another chapter.

Learn More

Axa SA (A.M. Best # 085085)

For ratings and other financial strength information visit www.ambest.com

Kate Smith is managing editor of Best’s Review. She can be reached at kate.smith@ambest.com