Marijuana: Emerging Risks

Growth Industry

As states across the country move to legalize cannabis, insurers assess the risks but remain cautious of market entry.

When she speaks at insurance conferences, Camille Dixon encourages carriers to visit marijuana dispensaries and manufacturing plants.

“Ask for tours,” she says. “Look at these operations. You'll see they're wearing gloves and following OSHA protocols. See for yourselves how far this industry has come as a regulated market.”

Dixon may sound like a representative of the cannabis industry, championing its cause. She is not. She is a regulator, championing insurance for cannabis-related businesses.

Dixon is director of the Cannabis Insurance Initiative for the California Department of Insurance. As a regulator, her mission is to make sure insurance is available for consumers. In this case, she said, cannabis companies are the consumers, and they currently are underserved.

We probably won’t see it legalized at the federal level this year. But maybe after the 2020 election. We’re seeing sentiment changing, just not as fast as the industry needs it.

Phil Skaggs

American Association of Insurance Services

“While there is some insurance available, we definitely need more,” Dixon said.

Around the country, states are moving to legalize cannabis, a term that's used interchangeably with marijuana but actually is the plant from which marijuana and its non-psychoactive cousin hemp are derived. Medical marijuana is now legal in 33 states, and both medical and recreational use of marijuana is legal in 10.

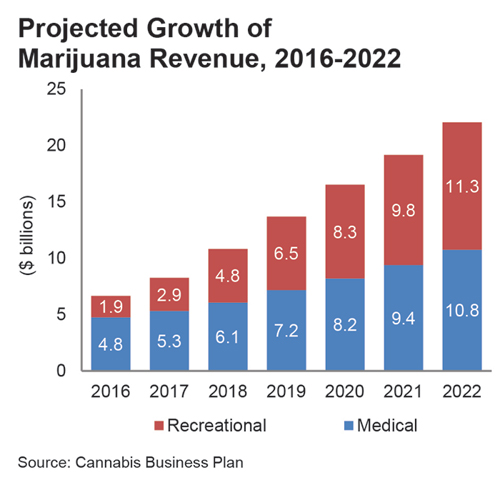

Americans spent more money on legal marijuana ($8.1 billion) in 2017 than they spent on coffee ($5.1 billion), and legal marijuana sales are expected to double from $10.9 billion in 2018 to $22.1 billion in 2022.

Despite the size of the industry, though, only 25 carriers (mostly non-admitted) currently offer insurance to cannabis-related businesses, according to AM Best. And the coverage that is offered tends to be limited.

“It's a fragmented market,” said attorney Ian Stewart, who co-chairs the cannabis law practice for Wilson Elser Moskowitz Edelman &Dicker. “There are many carriers who only offer one or two lines of coverage. None offer the full spectrum.”

The insurance industry's skittishness stems from federal laws. Under U.S. federal law, marijuana is a Schedule 1 narcotic, which the U.S. Drug Enforcement Administration defines as “drugs with no currently accepted medical use and a high potential for abuse.” Banks that accept deposits from marijuana-related businesses are subject to prosecution for money laundering under federal drug laws.

Though the U.S. government has taken no action against insurers that serve the cannabis industry, experts say carriers are unlikely to jump into the market until marijuana is decriminalized at the federal level and banking regulations change.

Congress is currently considering a bill that would protect banks that service state-legal cannabis businesses. Passage of the SAFE Banking Act, Stewart said, would also force the U.S. Treasury to update the Financial Crimes Enforcement Network (FinCEN) guidelines that all financial institutions, including insurers, must follow when dealing with marijuana-related businesses.

“If the banking gets cleared up, you're going to see a lot of carriers waiting on the ledge to jump in,” Stewart said.

If the banking gets cleared up, you’re going to see a lot of carriers waiting on the ledge to jump in.

Ian Stewart

Wilson Elser

Robert Raber, associate director of North American property/casualty for AM Best, pointed out that insurers were quick to enter the market in Canada once marijuana was legalized.

“Legality is the biggest hurdle for insurers in the U.S.,” Raber said. “You can see how in Canada, where it was legalized at a national level, there was much more interest by insurance companies to step in and meet the need.”

While there is debate about whether the 2018 Farm Bill, which laid the framework for legal production of hemp, signaled a softening of the federal stance on cannabis, there is a sense that the U.S. is moving toward federal decriminalization of marijuana.

“It's only a matter of time before cannabis is de-scheduled,” Dixon said. “At that point, we will start to see a lot more insurance products. Even though they may not be willing to offer products because of the federal issue, a lot of insurance companies are paying attention to the market.”

Last month, the Ending Federal Marijuana Prohibition Act of 2019 was introduced in Congress. The bipartisan bill seeks to remove marijuana from the federal Controlled Substances list.

Federal legalization would be a game-changer for many insurers, according to Lorie Graham, chief risk officer and vice president of product development for the American Agricultural Insurance Company. While American Ag does not currently offer coverage to the cannabis industry, Graham said it is preparing to do so.

“We are researching, studying, trying to understand it so that when it does become available to insure, we are prepared,” she said. “We're looking at emerging trends, making sure we're staying on top of it as it unfolds, and evaluating products and processes to make sure we're ready when it becomes legal.”

When federal decriminalization will occur, though, remains to be seen.

“While cannabis is becoming a political platform, it is not a priority,” Phil Skaggs, assistant counsel for the American Association of Insurance Services, said. “We probably won't see it legalized at the federal level this year. But maybe after the 2020 election. We're seeing sentiment changing, just not as fast as the industry needs it.”

Cannabis Risks

Dixon said insurers are actively reaching out to their departments of insurance to ascertain what the cannabis industry looks like and what industries it compares to.

The answer, she says, is that the cannabis industry is not all that unusual.

“This is a normal business,” Dixon said. “We can't stress that enough.”

A million-dollar loss is likely to happen, especially if you have a duty to defend. That doesn’t even include the payout for damages; it's just the response letters to the lawsuit.

Mike Aberle

CannGen Insurance Services

Mike Aberle, senior vice president of CannGen Insurance Services, said many of the risks cannabis-related businesses face are similar to other businesses.

“Retail is retail,” said Aberle, whose cannabis-focused managing general agency is a subsidiary of Next Wave Insurance. “You have a seller and a buyer. You have a storefront. That doesn't change. You just need to find the baseline, and then add in what makes that particular business unique.

“Nothing the cannabis world does is any different than the normal world when you think about classifications. The product is just a widget. Whether you're growing that widget, manufacturing that widget, selling that widget or testing that widget, it's just a widget. The risk is not the product; we're not insuring nuclear waste.”

While dispensaries may be at high risk for theft because they carry a lot of cash and valuable products—as do jewelry stores, banks and video game stores—they also have extensive security in place. State regulators have been very prescriptive in their requirements for cannabis businesses, down to the pixilation of surveillance cameras and the fire ratings of safes and vaults.

“The video monitoring systems in some of these businesses is cutting edge, like you'd see on a casino floor,” Raber said. “The safes are similar to what you'd see in a jewelry store or a bank. They have double locks, triple locks and video cameras everywhere.

“There's a higher level of concern about theft, but also a higher level of risk mitigation and security.”

The biggest risk the cannabis industry faces, experts say, is uncertainty. Not only is there uncertainty around regulation, but there also is uncertainty around the nature of the lawsuits this industry will face.

“Because of the federal and state conflict of laws, there is a huge risk of whether the federal government will act, and when, and how, and for what purpose,” Skaggs said. “And the state regulations themselves are open to interpretation and open to multiple changes. California went through a dozen iterations of their cannabis regs before settling on what they claim to be the final. What that did was, it made a lot of cannabis companies react overnight to stay in compliance. Compliance is a big risk.

“There also is uncertainty of the courts. There is no real telling which way a certain court or judge will rule.”

Like other emerging industries before it, the cannabis industry is, and will continue to be, a target of the plaintiffs' bar. While there haven't been many class-action lawsuits yet, experts say there inevitably will be. “Plaintiffs will look to cash in on the popularity of cannabis,” Skaggs said.

Just a few years ago, Stewart would point to product liability whenever he was asked about the risks associated with insuring the cannabis industry.

“My stock response was, 'Product liability is by far the cat risk of the industry,'” he said. “And that still may be true. But we haven't seen in the intervening years a lot of product cases. What we are seeing are product liability-adjacent cases.”

Product labeling and marketing are two areas generating early lawsuits. That could include packaging that's appealing to minors or labels that claim a product is the “purest” or “strongest.” Lawsuits also could arise from labels that contain incorrect information on the cannabinoid panel.

“You have strict guidelines at the state level of what has to be included on a cannabis label,” Skaggs said. “If they have something that is in the wrong font size or if they don't include a logo that the state requires, then the plaintiffs' bar can bring a class-action lawsuit and seek millions of dollars just in penalties. That can put companies out of business in a matter of months.

“We already saw something like that with the health supplement industry. They were a huge target five or 10 years ago of the plaintiffs' bar because of the same thing—making claims on their products that couldn't be supported.”

For insurers, Aberle said, litigation costs are a big concern. Defending cannabis companies against allegations of injury or wrongdoing quickly becomes expensive.

“There's a difference between product liability injury and product liability litigation,” he said. “Litigation always comes first. You might never get to an injury because you prove you were right. So it's the litigation that is the biggest risk.”

Aberle said the duty to defend is a critical part of coverage. Most insurers, however, include defense costs in the policy limits. And limits are low.

According to David Blades, senior industry researcher for AM Best, most carriers who are entering the marijuana market offer three types of policies—commercial general liability, property liability and product liability—with limits of $1 million per occurrence and $2 million aggregate.

“A million-dollar loss is likely to happen, especially if you have a duty to defend,” Aberle said. “That doesn't even include the payout for damages; it's just the response letters to the lawsuit.”

Coverages and Gaps

While California has two admitted insurers—Golden Bear and California Mutual—the vast majority of coverage is written by surplus lines carriers.

“This is what surplus lines carriers bring to the market—they focus on unique risks that the standard companies may not want to look at,” Blades said. “They have the freedom and ability to craft policy forms that provide coverage but also protect them from the exposures at hand.”

Dixon said the California Department of Insurance is grateful for the surplus lines stepping up, taking the risk and being early adopters in learning about the industry. But the limited availability of insurance providers creates high prices for insureds.

“One of the major concerns we hear from cannabis businesses is the price,” Dixon said. “When we get more companies in the market that are offering the product, that will cause prices to go down.”

To encourage market participation, California enlisted AAIS, Skaggs' organization, to create a business owners policy for cannabis businesses. CannaBOP, which offers property and liability coverage, was rolled out last year.

“The goal was to legitimize cannabis insurance,” Skaggs said. “This is something admitted carriers can get in on with limited work on their end.”

While traditional BOP policies contain Schedule 1 exclusions, CannaBOP removes any language that restricts coverage for cannabis and adds in more narrowly tailored restrictions. For example, it includes a chronic illness exclusion, territorial limitations (coverage doesn't extend beyond the state), track-and-trace limitations (no coverage for cannabis whose source cannot be traced), and a “compliance equals coverage” limitation, which says no coverage will be provided for claims arising from non-compliance.

Even with these efforts to expand coverage, experts say many gaps remain.

One of the most glaring is the low policy limits. “More and more of the insureds need $5 million or $10 million, if not more, depending on the size of the business risk,” Blades said. “A lot of carriers are not comfortable extending high limits right now.”

More capacity is needed for directors and officers, errors and omissions, and cyber, Stewart said.

“Those coverages need to come along,” Stewart said. “There are limited markets for them, and they're very expensive.”

Because licensed cannabis businesses are required to collect customer information, they are particularly vulnerable to cyberattacks.

“Cannabis entities are at a higher risk of data loss than other entities that would be similar in nature in other parts of the economy,” Stewart said. “When you walk into The Gap, you can pay with cash and walk out, and nobody knows who you are. But if you walk into any licensed cannabis facility, the first thing you do is hand over a state identification card, which they scan. They also have video rolling throughout the facility. Many times that feed is accessible live to regulators online, which means it's accessible to hackers. Their seed-to-sale tracking systems, which are part of the track-and-trace programs they use, are also accessible to regulators.

“So they are at a high risk for data loss. At the same time, they don't appreciate it because they're often startups and their eye is elsewhere. They're not thinking about data loss; they're thinking about compliance and other risk management issues. And the insurance markets are extremely limited for cyber.”

Experts say gaps also exist around cultivation, professional liability, special events and cargo.

“For cultivators in California who for the last two years have been ravaged by wildfires, the price of taking out a policy can be very expensive,” Skaggs said. “And it's only going to cover you for a fraction of what your actual losses will be. So that's a big gap that as an industry we need to solve.”

More coverage also is needed for festivals and conferences that may want cannabis on site for purchase or use. “How you attack that is fairly complicated from an insurance standpoint,” Skaggs said.

There's also a shortage of availability for professional liability coverage for cannabis experts who offer advice to these businesses. And because of its federal illegality, cannabis cannot be transported across state lines, which created issues for inland marine.

“Inland marine is another coverage line that's feeling its way through the exposure,” Blades said.

That sentiment can be felt across the insurance industry, Blades said.

“This is an emerging area,” he said. “Insurers are just finding out the full scope of the risks they may have to deal with and the types of claims they may get. That's creating some trepidation.”

With legalization expected on the horizon, though, insurers increasingly are exploring the cannabis industry.

“Even though we're seeing some consternation with insurance companies,” Dixon said, “it's not something they're ignoring, because it does appear to be moving toward legalization.”

Five Myths

Camille Dixon

Camille Dixon, director of the Cannabis Insurance Initiative for the California Department of Insurance, identified five misconceptions that insurers have about the cannabis industry.

Myth #1: The industry is unprofessional.

“Insurers don't understand or don't know that these are sophisticated businesses. They have scientists, lawyers and accountants. It's a very professional business.”

Myth #2: There's no due diligence.

“There's a misconception that they're not required to do due diligence to make sure the products are safe. This industry is highly regulated. If you look at the California regulations for licensing, you will see there are hundreds of pages of regulations that have to be complied with.”

Myth #3: A wait-and-see approach is needed.

“No, we should be looking at this and figuring out how to address this industry. These businesses need to have the same risk management protocols in place that any other business would.”

Myth #4: No banks work with the cannabis industry.

“That isn't true. If you look at the Financial Crimes Enforcement Network (FinCEN) reports from last quarter, you'll see that nationally there are several hundred banks that are working with the cannabis industry.”

Myth #5: Compliance is impossible.

“Another misconception along the banking line is that it's not possible to be compliant. Well, the federal government has come out with guidelines. Some would say guidance is not law. That's absolutely true. But there is a way to work with the industry to make sure protocols are being followed according to the FinCEN guidelines and the Cole Memorandum. There is a path. It is a business risk decision. But if people want to work with the industry, there is a path to do it.”

In the Weeds: Defining Cannabis, Marijuana and Hemp

While the terms marijuana and cannabis are often used interchangeably, the U.S. government defines marijuana as the leaves, flowers, stems and seeds of either the Cannabis indica or Cannabis sativa plant. With tetrahydrocannabinol (THC) levels that can reach 30%, marijuana has a psychoactive effect and is used for medical and recreational purposes.

Hemp is also a member of the Cannabis sativa family, but contains THC levels of less than 0.3%. Because of its low THC levels, hemp does not give the effect of a “high.” It is used for industrial purposes.

Both hemp and marijuana contain cannabidiol (CBD), a non-psychoactive cannabinoid believed to offer medicinal benefits.