Insurtechs

The Billion-Dollar Question: What’s the Allure of Investing in Insurtechs?

The scale of the insurance industry plus its lack of technological sophistication have venture capitalists eyeing insurtechs.

- Caribou Honig

- September 2021

-

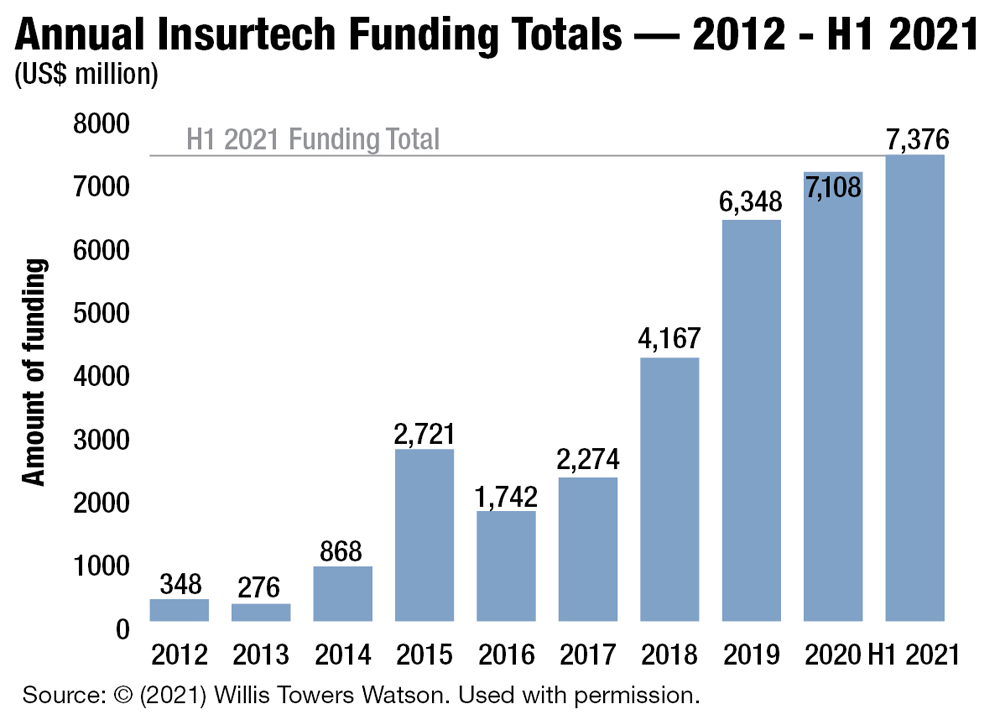

Insurtech. It's a term that barely existed five years ago even though technology has always played some role in insurance. The word evokes a multitude of visceral responses, ranging from disdain to excitement, from industry executives. Yet, as indicated by reports from Willis Towers Watson and others, venture capital has flocked to the category at an almost inexplicable pace.

Why? What justifies the accelerating pace of funding? What might be the logic of investors wiring literally billions of dollars into these startups? The answers might indicate not just the future of insurtech, but also hint at the future of insurance.

As with most topics, it's helpful to start by following the money. Specifically, consider how venture capitalists construct a portfolio of investments and what they expect from those startups, or what is often called “VC math.” As a venture-stage investor, the goal is to deliver five times the returns on the money entrusted to me, within 10 years or so. That's five times overall, not five times on each investment.

Success in venture capital hinges on asymmetric risk. When I write a check, I expect one-third of the investments will crater—a total write-off. Another one-third will be mediocre, returning the principal or a bit more. Success of the fund will depend on a handful of winners in the portfolio. The operative question is not how many losers I have; rather, it's all a function of the magnitude of my winners. If I have a few investments that deliver 50 times, my losing bets will be forgiven and forgotten.

Considered in light of all the venture capital pouring into insurtech, the implication is clear: Venture capitalists must believe there are opportunities to get 50 times if they invest in the right insurtech startup.

Here's why: Venture capitalists salivate when they see a huge market. In the spirit of not preaching to the choir, everyone reading Best's Review is aware of the scale of our industry. Insurance is crucial to a well-functioning economy in developed countries, and emerging markets present almost unlimited growth opportunities. Startups don't need to dominate an insurance category to deliver a huge win. Capturing even 1% market share can easily justify multibillion-dollar outcomes.

Venture capitalists also salivate when technology has yet to be deployed. The internet has been a catalyst for change in many white-collar industries such as banking, media and travel. Insurance lagged. Since then, we have seen a long list of additional, foundational technologies come to pass, including satellite data, smartphones, a mature cloud infrastructure, and breakthroughs in machine intelligence, to name just a few. These present the opportunity to deliver enormous value for startups and incumbents alike.

In fact, there are two types of startups to unlock this potential. Business-to-business startups sell solutions to deploy basic technology for the benefit of existing brokers and carriers. Compare that to customer-facing startups, which build upon those technologies to compete head-to-head against incumbents. Many venture capitalists orient to one type of startup or the other, but they share the common thesis that the insurance industry as a whole will derive huge benefits from technology.

They also like to identify vulnerable incumbents. No doubt this will stir some controversy. While there is room for honest debate, many in the venture community do see insurance as an industry full of vulnerable incumbents. Much of that arises from the lack of widespread technology adoption mentioned above, and an over-reliance on legacy technology. Many see an even bigger opening as the natural result of legacy culture: Successful companies often struggle to anticipate and adapt to competition from new entrants … until it's too late.

Consider the current environment—a huge market plus pent-up technology plus a belief that incumbents will be slow to respond. Taken together, these create the conditions to support the 50 times outcomes required by VC math. With big exits across the category recently, many venture capitalists who placed early insurtech bets saw their conviction affirmed and well rewarded.

Success begets success, and in the venture world, big exits drive a positive-feedback cycle. With ever more funding for these startups available, insurtech has established itself as a mainstream venture category. As it fulfills its promise, we will see innovation further accelerate to the benefit of both the insured and the industry itself.

Best’s Review contributor Caribou Honig is chairman and co-founder of InsureTech Connect, as well as a partner at SemperVirens Venture Capital. He can be reached at bestreviewcomment@ambest.com.

Related: