What AM Best Says

Asbestos and Environmental Losses Continue

Best’s Market Segment Report (Excerpt): No Slowdown in Asbestos and Environmental Claims (November 28, 2018)

Asbestos losses have not slowed down, with the property/casualty industry reporting an average $1.9 billion in additional losses per year over the past five years (2013-2017). Quantifying the industry's ultimate loss exposure is difficult, given the significant advancements in medical effectiveness, as well as developing litigation strategies.

Environmental losses also show no sign of slowing down, with the industry reporting approximately $800 million in additional losses per year. The industry's ultimate loss exposure continues to grow, and, as a result, AM Best has raised its estimate of the ultimate net environmental losses for the industry to $46 billion, which also required adjusting the environmental ratio benchmark to 12 times from the previous benchmark of 10 times.

AM Best will continue to monitor both asbestos litigation and losses as well as environmental losses, and will periodically revisit this benchmark, as needed.

Net Ultimate Environmental Loss Estimate up $4 Billion

AM Best has raised its estimate of net ultimate environmental losses for the U.S. P/C industry to $46 billion, up $4 billion over its previous estimate. The increase is due to the continued development on original sites that have been found to be more toxic than originally thought, and the associated increase in cleanup and defense costs.

The increase in the environmental estimate reflects the fact that the industry continues to incur losses of approximately $750 million per year, while paying out $760 million. Previous expectations factored in a reduction in these patterns, but the pace has not yet declined in a meaningful way. The industry's environmental losses have reached $46 billion, and the environmental issue will be here for years to come.

Our estimated net ultimate asbestos loss of $100 billion remains the same. Accordingly, our estimate of the ultimate industry losses for asbestos and environmental (A&E) is now $146 billion. As of year-end 2017, the industry had funded approximately $130 billion or 89% of A&E exposure through a combination of paid losses and loss reserves.

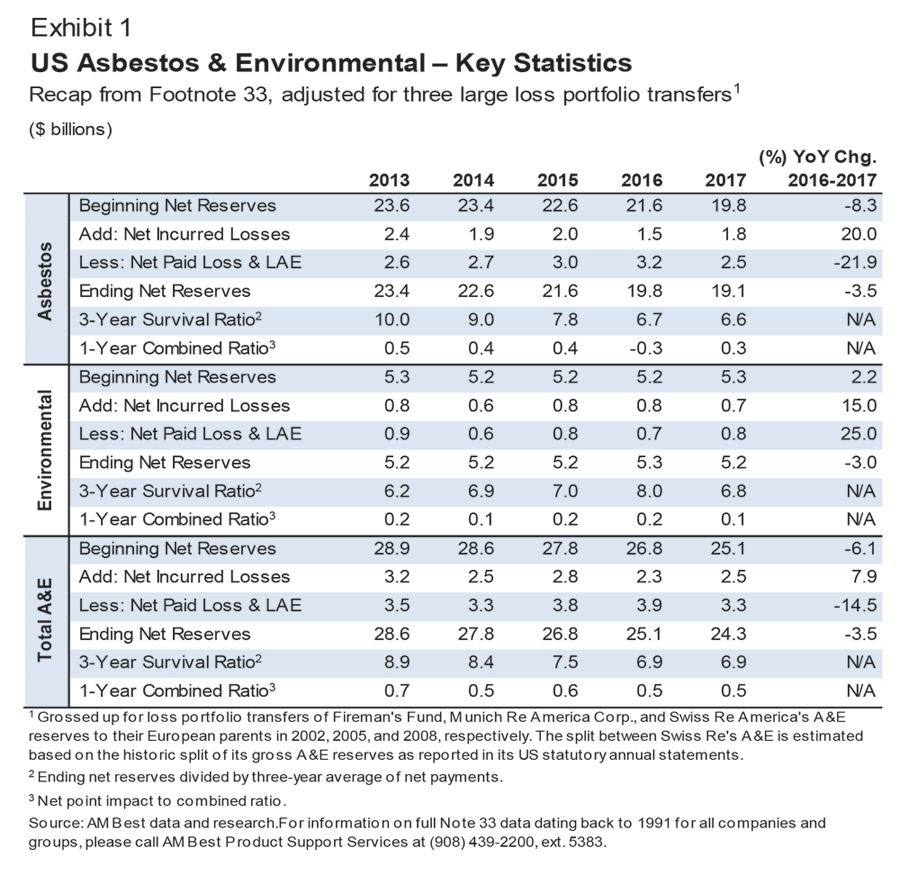

Losses incurred have been relatively steady over the past five years, as have A&E loss payments. From 2013 to 2017, the industry paid out more every year than it incurred, with payments of $17.8 billion for A&E claims and $13.3 billion in incurred losses. Asbestos incurred losses came to approximately $10 billion, and payments, $14 billion, while environmental losses came to $3.7 billion, and payments, $3.8 billion. At year-end 2017, asbestos reserves had decreased nearly 4% to $19.1 billion, and environmental reserves, by 3.0% to $5.2 billion. The industry's paid A&E losses remain concentrated, with the Top 30 insurer groups generating nearly 95% of the total. As in the past, the Top 30 insurer groups accounted for 94% of the industry's total A&E reserves.

The information in this report is based on AM Best's review of the statutory annual statement footnote 33 data for year-end 2017 (Exhibit 1), including footnotes dating back to 1991, the earliest available year with the National Association of Insurance Commissioners (NAIC) annual statement and augmented by AM Best proprietary data. All figures in this report are net of reinsurance and adjusted to include the A&E liabilities loss portfolio transfers (LPT) by Fireman's Fund Insurance Companies (2002) to its German parent, Allianz SE; Munich Reinsurance America Corp. (2005) to its German parent, Munich Re; and AM Best's estimate of the Swiss Reinsurance Group (2008) to its Swiss parent, Swiss Re. The data prior to 2009 reflects Swiss Re's actual net U.S. losses prior to the LPT, as reported in those years. Swiss Re's published parent financials provide total A&E data but do not break down the asbestos and environmental totals. Based on the gross figures, Exhibit 1 recaps the industry's net A&E over the current five-year period, adjusted for the three LPTs. All exhibits in this report are on an adjusted basis and reflect group organizational structures in place as of year-end 2017.

Asbestos Under Trump's Environmental Protection Agency

Mining asbestos in the United States is currently illegal, but the material is still imported in large quantities, generally for use in the manufacture of chlorine—the historical spike in asbestos imports in 2016 is attributable overwhelmingly to this industry. Furthermore, although the 2016 Frank R. Lautenberg Chemical Safety for the 21st Century Act granted the EPA broader authority to restrict and even comprehensively ban the use of asbestos, subsequent developments in the EPA's leadership and focus under Donald J. Trump's administration make it unclear whether the agency has any intention of exercising such authority. The current administration, after heavy lobbying by the chemical industry, is scaling back the way the federal government determines health and safety risks associated with the most dangerous chemicals on the market. The EPA is planning to modify regulations on asbestos, which may allow use of the substance in manufacturing in the U.S. again. In June 2018, the EPA proposed a significant new rule for certain uses of asbestos (including asbestos-containing goods) that would require manufacturers and importers to receive EPA approval before starting or resuming manufacturing, or importing or processing of asbestos. This review process would require that the EPA evaluate the intended use of asbestos and, when necessary, take action to prohibit or limit such use. This proposed SNUR (Significant New Use Rule) has loosened the EPA's 1989 restrictions on asbestos products and could allow companies to use asbestos in products such as adhesives, sealants, and pipeline wrap if they are approved by the EPA. The impact of these actions is somewhat uncertain. There's reason to believe, though, they will change little for the average American. The most likely outcome of the changes will be that the agency finds lower levels of risks associated with many other chemicals, and as a result, imposes fewer new restrictions or prohibitions.

This Best's Market Segment Report is available at www.ambest.com.