Asset Management

Insurers Increasingly Seeing Private Equity Enter Investment Portfolios and the Boardroom

Once seen as a realm of buyouts and structured finance, private equity firms are learning to appreciate insurers for the lower yield and reliable credit markets they represent. Meanwhile, insurers stung by low interest rates see a chance for higher investment yields with private equity.

- Terrence Dopp

- September 2021

-

Key Points

- Trend: The admitted assets of private equity-owned insurers have swelled since the 2008 financial crisis; at the same time, insurers eye the asset class as a more attractive place to park their money.

- Insurers: Stung by years of low rates and searching for a higher yield, insurers are increasing partnerships with asset managers that specialize in private equity and the amounts of money they put into it.

- Private Equity Firms: In some respect, they’re finding more reason to believe owning a stake in insurers will bolster access and create new markets for the credit and lending products they sell.

By all accounts, the deal announced in July between Blackstone and American International Group Inc. was notable in size and scope.

The private equity firm will spend $2.2 billion to buy a 9.9% stake in AIG's Life &Retirement group in an all-cash transaction. At the same time, Blackstone plans to acquire AIG's interests in a U.S. affordable housing portfolio for $5.1 billion and will manage an initial $50 billion existing AIG investment portfolio.

The three components of the single transaction encapsulated a recent trend in the insurance industry—the increasing interplay between private equity (PE) and insurance. PE firms have been buying up insurers in the race for permanent capital, while at the same time insurers looking for investment returns also have been stepping up their willingness to place parts of their investment portfolios within private equity.

Gilles Dellaert, who heads Blackstone's insurance business, said the trend began with the low-interest rate environment and the desire to increase returns. Insurance companies paired up with asset managers to gain access to higher yielding products beyond in-house investment managers. It grew from there as the firms began to recognize that insurers presented a newer set of opportunities in their own right.

Dellaert didn't address specifics of the AIG deal directly because it hasn't closed; however, he said Blackstone has differed slightly in that it hasn't sought to outright buy insurance companies in most deals, instead focusing on taking minority stakes.

This is about an evolution of our business model to lower yield, lower risk, and serving a broader base of audience within an insurance company context.

Gilles Dellaert

Blackstone

“Certain asset managers saw opportunities to buy into insurance companies,” Dellaert said. “This trend is clear and it's only accelerated. Insurance companies' in-house investment operations oftentimes are not really set up to be competitive against some of these newer entrants because they don't have the same direct origination or sourcing capability that a firm like ours has.”

Deals such as the AIG transaction provide firms like Blackstone with a new avenue beyond their traditional portfolios of private equity and opportunistic real estate with yields as high as 20% in favor of continuing to build out their credit and lending operations.

Related: AIG, Blackstone Agree to Three Billion-Dollar Transactions, Including AIG Selling Equity Stake, Housing Portfolio

“For us, what is attractive is that it gives us scale into those business lines,” Dellaert said. “This is about an evolution of our business model to lower yield, lower risk, and serving a broader base of audience within an insurance company context. And ultimately generate a fee model that is lower in nature than the PE business is but very well diversifying as a result and additive.”

Private equity rang in 2021 with several large transactions.

In January, one transaction saw Blackstone acquire Allstate Life Insurance Co. and some subsidiaries from Allstate Corp.—excluding Allstate Life Insurance Company of New York—for $2.8 billion. A month later, Elliott Investment Management took an undisclosed stake in annuity writer Principal Financial Group Inc.

Prime Targets

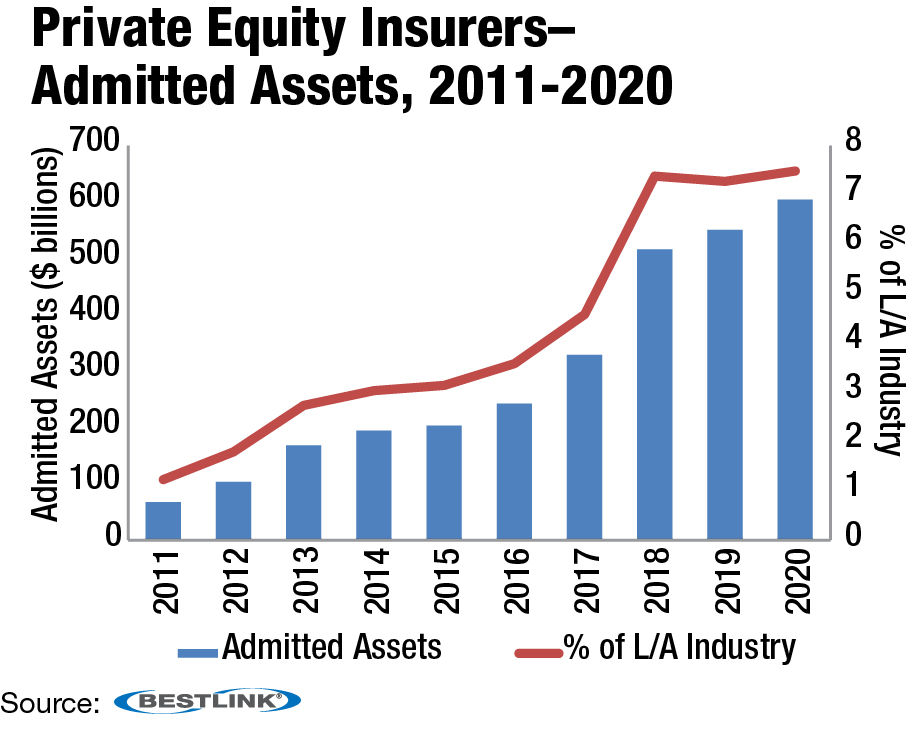

On the private equity end, the 2008 financial crisis prompted some managers to begin seeking investments with a longer horizon than the traditional buy-out model, and insurance companies fit that bill, according to Best's Special Report: Insurance Companies Remain Prime Targets for Private Equity. The firms zeroed in on life and annuity insurers with their large balance sheets that offered both a reliable stream of invested assets and a permanent source of stable capital.

The July 2021 report from AM Best found at least 70 private equity-owned insurance companies, dubbed PE insurers, and the total of admitted assets grew to $604.1 billion at year-end 2020 from $67.4 billion in 2011. The report noted that these numbers exclude offshore operating companies used by some entities due to incompatibility of that data. The pattern is most pronounced within annuities, which accounted for 70% of premiums written at PE insurers, the report found.

Private equity firms also infused the insurers with capital for rapid growth, which the report noted is something “insurers do not typically execute well.” They also tended to bolster the capital and surplus of the acquired insurers.

At the same time, insurers had an appetite for investing in private equity in 2020.

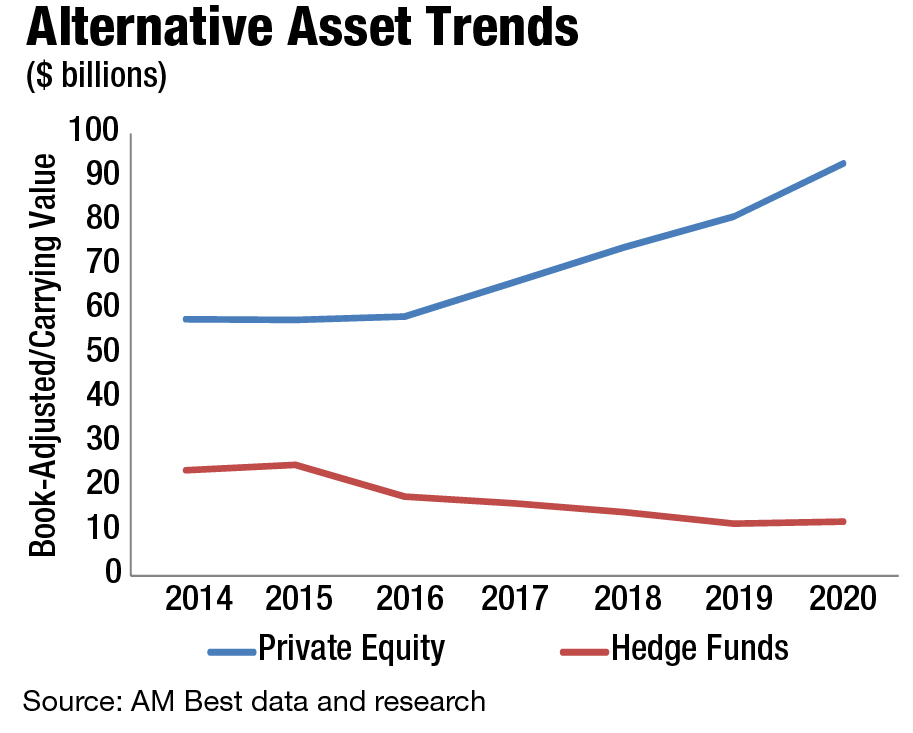

The book-adjusted/carrying value of U.S. insurers' investments in private equity increased by 14.8%, with life and annuity providers accounting for $71.7 billion or 75% of the total in a five-year high, according to another Best's Special Report, Private Equity Investments Still Attractive to US Insurers.

“As private equity investment values continue to rise, the number of private equity investments is growing as well, slightly over 10,000 throughout the insurance industry, making 2020 the seventh year that the number has increased—up roughly 40% since 2013,” the June 2021 report said.

Luke Schlafly, global head of insurance solutions at PineBridge Investments, said in the current environment insurance companies are looking for more ways to drive net investment income, particularly in life and annuities. Doing so has caused many to partner with asset managers that provide them with ways to step outside of their traditional investment spaces in a quest for yield.

“If there's a need for greater returns and income, then of course insurance companies are also going to look to partner with asset managers that they believe have strategies that fit into that but are differentiated relative to historically what they invested in,” Schlafly said. “This trend makes a lot of sense.”

Along with being more attractive in terms of potential investment return, private equity investments are also more favorable in some instances because of the way they are marked to value compared to public equities, Schlafly said. “If they can both generate a higher return and with less accounting volatility, that's of course a good combination.”

Looking at the private equity market as a whole, it isn't hard to understand the allure for insurance companies, which have dealt with both the long-term drop in interest rates and the pandemic's impact on private markets.

Brian Keleher, associate analyst at AM Best, said that PE insurers have had a higher net yield since 2016 compared to the broader industry—performing better in different asset classes, such as Schedule BA, common stocks—and they also have maintained a lower expense ratio. Part of that extra yield comes from the nature of PE: Half of their bond portfolios were in private placements over the last two years, compared to just 37% for the life and annuity industry in 2020.

“These private placements are often cheaper and offer better returns than public bonds,” he said. “These companies are less concerned about the less liquid nature of the private placement, but want to earn the extra yield.”

Another difference between PE insurers and traditional firms has been a greater willingness to tilt toward cash and shorter-term investments. Since 2010, these PE insurers have held double the allocation of cash and short-term investments, around 6%, compared to non-PE-owned peers, Keleher said.

Tom Rosendale, AM Best senior director, said at the moment the deals make sense for the seller and the buyer. From the PE vantage, many insurance companies looking to sell off some of their fixed-annuity business simply find the current interest rate environment unattractive. Many don't count the line as their core business and often don't have the risk appetite or the expertise to manage investment through the current spread compression.

“Of course the environment got even more unattractive from that perspective as we entered the pandemic,” Rosendale said, citing a drop in the 10-year Treasury. “Things are difficult from that perspective, and so a lot of companies who don't view those lines of business as core to their business models are finding, as they do their ERM analyses, that it makes sense to off load some of this business.”

Often, PE companies find they can tweak the investment portfolios associated with insurance liabilities to widen that spread, Rosendale said.

“Within traditional private equity, insurers are really just looking for good partners that can create the highest multiples, or IRR, on their capital,” Schlafly of PineBridge said. “There's been less structuring or customization for insurance companies, and I don't expect that to change as the NAIC really doesn't want equity or equity-like investments finding their way on to the debt schedule in state filings.”

Related: