Catastrophes

Winds of Change: Derechos, Snowstorms and Other Catastrophes Are Becoming a Growing Problem for Insurers

This year’s deep freeze in Texas and last year’s derecho in the Midwest have gotten insurers talking about and moving toward better modeling, risk selection and pricing.

CHICAGO: A police officer stands guard following unrest on the city’s West Side moments before a derecho hits the area on Aug. 10, 2020. The storm, with wind gusts close to 100 mph, downed trees and power lines as it moved through the city and suburbs.

Getty images/Scott Olson

Key Points

- Weather Alert: In 2020, insurers were hit with $76 billion in global losses from natural catastrophes, a 40% rise from the prior year, according to Swiss Re.

- Coming Into Focus: A growing number of catastrophes do not look or act like the long-tail tropical storms and hurricanes that traditionally account for the largest insurance losses.

- Taking Cover: Stricter building codes and improved communication with policyholders and other stakeholders are two ways insurers are preparing to weather these growing types of storms.

Just hours after a derecho touched down in Iowa last August, First Maxfield Mutual President Randy Druvenga was in a whirlwind of his own. From his office in Denver, Iowa, about 68 miles from Cedar Rapids—where the derecho did considerable damage, Druvenga began contacting the company's reinsurers and agency force and assembled staff, adjusters and contractors on the ground. He and his team were prioritizing claims, utilizing estimating software and satellite images to assess property damages, and finding temporary homes for displaced members and livestock.

First Maxfield only writes in the state, so many clients were affected, with one member's house a total loss after a two-story barn from across the road blew off its foundation and into their home. Cell towers were knocked down by powerful winds and “COVID-19 hanging over our heads,” added Druvenga, made it difficult to reach some policyholders and get into homes where others were quarantining.

In February, as a historic deep freeze pummeled the southern U.S., Arrowhead Insurance Risk Managers Executive Vice President and Chief Underwriting Officer Niels Seebeck was on the phone with a Texas customer who was standing in his 40-degree kitchen. “I told him to hang up the phone and turn off his pipes before they froze. He didn't know to do that or to winterize his home because storms like these are rare events in that part of the state.”

While derechos, or straight-line thunderstorm wind events, are fairly common in the Midwest, last year's 14-hour event was an anomaly in that it spread across thousands of square miles in multiple states, pounded highly-populated Iowa cities including Des Moines and Cedar Rapids and damaged millions of acres of crops in the nation's Corn Belt, leaving insurers with roughly $7.5 billion of unexpected losses, according to Aon.

The February winter weather outbreak disrupted businesses and supply chains and left many homeowners in Texas with burst water pipes, damaged roofs and widespread power outages sparked by a crippled electric grid. The extreme weather, which hit the Lone Star State particularly hard, unveiled infrastructure inefficiencies in areas not often hit by severe winter storms, prompting insurers such as the Alpharetta, Georgia-based Arrowhead to scramble to help unprepared insureds.

These deadly events are examples of a growing type of catastrophe, one that Karen Clark &Co. co-founder and CEO Karen Clark calls “non-tail, large-loss” or “not in the tail of the distribution.” Unlike a rare event—think, a one-in-100-year hurricane that could cause losses exceeding $100 billion—large-loss, non-tail events occur more frequently and sometimes in areas not typically associated with those perils.

While non-tail calamities don't cause single event losses large enough to make it into the tail of the loss distribution, Clark said, “collectively, on an annual aggregated basis, insurers now are paying out about twice as much for those events than the long-run expected annual average for hurricanes.”

Last year's derecho is now the single costliest thunderstorm cluster event on record, according to Aon's Weather, Climate & Catastrophe Insight 2020 Annual Report. Druvenga, who also sits on the board of Grinnell Mutual in Iowa, noted the storm was five times larger than any other single event in Grinnell's history.

Industry reports say the financial toll exceeded that of nine of last year's record 10 U.S. landfalling hurricanes and tropical storms.

While claims from this year's winter weather outbreak continue to roll in, industry analyses suggest the final insured losses could settle between $12 billion and $15 billion.

First-quarter earnings announcements also offer a glimpse into the event's wrath. In April, Allstate Corp., the second-largest homeowners writer in Texas, announced it incurred estimated gross catastrophe losses of $1.3 billion from the event, while Everest Re Group Ltd. reported a nearly $203 million loss to its reinsurance segment and another $47 million to its insurance segment.

Such numbers are unusual in what is typically a benign first quarter for significant cat losses, according to a Best's Commentary, Potential Record Catastrophe Losses for Texas Insurers Due to Winter Storm Uri. But some industry experts are now seeing a shift and expect costly non-tail catastrophes throughout the year to become the norm.

Modeling Changing Risks

Druvenga said the derecho “literally blew some of the models right out of the water due to its severity, enormity and uniqueness.” Iowa State University meteorology professor Bill Gallus said in an interview with a Des Moines TV station that most models failed to provide forecasters with a hint as to the impending line of intense storms.

However, just weeks before this year's winter storm in Texas struck, Karen Clark &Co. released the first version of its winter storm model, which estimated the likelihood of an impending $20 billion winter storm loss event—more than six times the yearly average for that peril, Clark said. She added that this year's storm is characteristic of a non-tail, large-loss catastrophe that “was in our model before the event occurred.”

“From what our models show, that type of arctic air outbreak winter storm is now likely a one-in-75 loss event,” Clark said. “The main thing for insurers is that they don't want any surprises or to be looking in the rearview mirror and have to make model adjustments after a loss.”

Risk levels are changing, “and what was once a one-in-100-year event might now be considered a one-in-75-year or a one-in-50-year event today,” noted Steve Bowen, a meteorologist and head of catastrophe insight at Aon. More insurers are now being forced “to think outside the box about events that may not previously have been on the radar or those we assumed would never be plausible in our lifetime,” he added.

Insurers are trying to get a better handle on those exposures, and “seeking more usable, modelable risk data to help us do that,” Seebeck said. “Having extremely robust information will help determine our position and allow us to analyze it to make our portfolios accurate. Today, that's probably one of the most critical things the industry is focused on, and it's something we take great pride in our ability to do.”

Druvenga said Grinnell Mutual plans to recalculate prediction models for catastrophic weather, while First Maxfield Mutual will hire additional staff to handle the rise of non-tail catastrophes.

“If we're going to put insurance policies in place, we need to be able to service them at the time of loss. Our industry will continue to plan for future events. It's the right thing to do. The worst thing we can all do is sit back and hope that another event like last year's derecho doesn't happen again,” he said.

From what our models show, that type of arctic air outbreak winter storm [in Texas] is now likely a one-in-75 loss event.

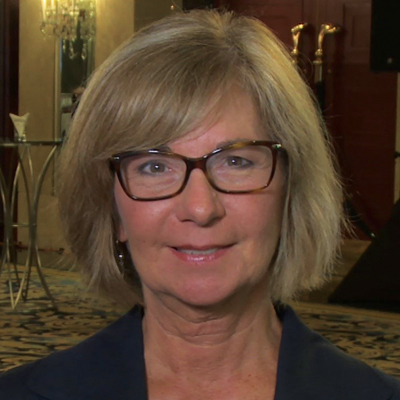

Karen Clark

Karen Clark & Co.

On the Storm Front

Texas is no stranger to cold weather events, but the intensity, scale and staggering losses of this year's winter weather outbreak—caused by a rare weakened polar jet stream—made it anything but typical. Many fear this is a warning of things to come, as changing weather patterns continue to unfold, creating non-tail events that could threaten the bottom line for insurers.

Last year's derecho was one of 416 global natural catastrophes that in 2020 collectively generated $268 billion in economic losses—8% more than the average annual losses of this century, according to Aon.

The good news, said NAMIC Senior Vice President Neil Alldredge, is that insurers and reinsurers are well capitalized to weather those storms. Less promising, Clark noted, is that total loss amounts from weather events—including non-tail, large-loss events—will likely continue to climb each year. That's because changing weather patterns are exacerbating risks such as rising populations in hazard-prone areas and increasing global wealth, and largely driving those costly losses. In areas like the southwestern U.S., climbing temperatures and drier air are creating more droughts and wildfires, while rising sea levels and increased evaporation are causing a spike in inland flooding in other locales.

These kinds of changes, Alldredge said, are fueling more intense storms, widening their geographic reach and, in turn, driving up claims.

That was the case in February in Texas, where Waco set a record for “the most consecutive hours under freezing, or 32 degrees, at about 205 hours, or about eight-and-a-half days,” Marc Marcella, a principal scientist at AIR Worldwide, told AM Best TV.

The majority of losses from this year's winter storm in Texas fell to commercial carriers, Clark said. Smaller insurers and those writing exclusively in the Lone Star State also were hard-hit, according to Best's Commentary.

These events have highlighted problems currently being discussed by insurers and government officials. For example, the winter storm made clear that building codes have not kept pace with changing weather patterns, and many home- and business-owners failed to winterize in areas typically known for mild winters. The Texas power grid could not handle the rapid surge in usage caused by temperatures colder than those in parts of Siberia.

Last year's derecho also highlighted infrastructure inefficiencies after winds in excess of 140 mph damaged nearly every building in Cedar Rapids—a city “not necessarily built with hurricane-strength winds in mind,” said Aon's Bowen.

Also underscored, he said, was the need for more communication to insureds and other stakeholders prior, during and after an event.

“One of the top things we discover in our post-event surveys is that many of those affected by these events are often unaware of the full range of risk or surprised at the level of impact at their individual property location,” Bowen said.

To help with this are products such as PURE360 Risk Management Consultation, which offers a detailed inspection of policyholders' homes and assesses their vulnerability to risk, and the PURE Situation Room, which preemptively offers relevant advice and assistance, proactively monitors severe weather events and deploys resources to mitigate or prevent damage to PURE members' property, said Jason Metzger, PURE's senior vice president and head of risk management and service operations.

Tools like those, along with pre- and post-event mitigation efforts, Alldredge said, create opportunities for insurers “to shine from a customer service perspective as they to work with their insureds.”

Alldredge noted he sees more discussions within the industry around building code changes, retrofitting practices such as enhanced insulation for water pipes, and ways to incentivize smart construction.

NAMIC has been working with groups such as the BuildStrong Coalition to support creation of federal financial incentives for states that adopt and enforce statewide building codes.

One of the top things we discover in our post-event surveys is that many of those affected by these events are often unaware of the full range of risk or surprised at the level of impact at their individual property location.

Steve Bowen

Aon

Weathering the Storm

Intense, damaging non-tail catastrophes have widened their reach across parts of the U.S. in recent years. In 2016, a deadly wildfire in Gatlinburg, Tennessee, caused millions in losses, and states such as Texas remain in the bullseye of inland flooding disasters. In Houston alone, 32%, or 186,481, of properties are now at risk for flooding, according to First Street Foundation's 2020 National Flood Risk Assessment Report.

Throughout the nation, floods are increasing in supposedly low-risk areas. Over the past 10 years, 36% of flood claims paid by the Federal Emergency Management Agency were for properties outside the so-called 100-year flood zone, according to Scientific American's website.

While Aon's Bowen pins that growing threat largely on climate change, he also points to urbanization, new construction, and terrain and land use changes that “make it more difficult for runoff from soil to absorb excess precipitation.”

Last year, insurers were hit with $76 billion in global losses from natural catastrophes, up 40% from the prior year, according to Swiss Re's sigma estimates. Most of those losses, it said, came from secondary perils including severe convective storms and wildfire.

Now the rise of those calamities—many of which fit the bill of non-tail, large-loss events—are sparking new conversations, including about how to classify them.

“Over the last 10 years, secondary perils like drought, severe convective storms and now winter weather, when aggregated together are reaching hurricane or higher levels and are becoming the predominant drivers of annual industry losses,” Bowen said. “That's now causing us to question whether we should even be calling them secondary perils anymore.”

Conversations like those also are forcing insurers to reevaluate how they price those risks. Alldredge expects if “new trends emerge, and places in the country represent a higher level of risk than before,” that could drive pricing adjustments in the sector.

“At the end of the day, insurers are in the business to sell insurance, and they'll find ways to get the pricing points they need,” he said. “So far signs aren't pointing to limited availability in the market, so insurers will instead be focused on getting the rate to match the risk.”

David Blades, associate director of industry research and analytics at AM Best, told AM Best TV that while one-off events like this year's winter storm in Texas may cause insurers “to trust the decisions that they made, the reinsurance they have in place, their risk appetite, their risk selection discipline,” he doesn't expect them to significantly change how they approach their businesses. But if those “severity-type loss events” occur at a more-rapid rate, he said, it could force some insurers to take a step back and reconsider how they'll handle their operations.

The Road Ahead

While changing weather patterns, population shifts and increasing property values suggest even more large, non-tail catastrophes coming from Mother Nature, insurers are battening down the proverbial hatches in preparation for their arrival and the losses they are sure to bring.

Clark said her firm accounts for climate change and evolving exposures such as non-tail, large-loss perils in its models, “and doesn't rely on historical data to do that.” However, some industry experts say not all catastrophe models have kept pace with the changing landscape, and they are now calling for updates to those models.

Clark said she expects the rising threat of costly non-tail calamities to force insurers to reevaluate how they price and manage the risk. But the good news, she added, is that the financial effects will not be solvency-threatening for most carriers. “However, they do cause much pain from year to year,” she said. “And we're now seeing more of them.”